Risk Mitigation in Corporate Renewable Energy Sourcing

Identifying and Assessing Potential Risks

Identifying Potential Risks

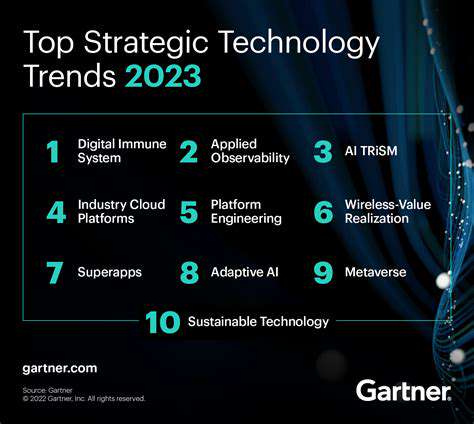

A crucial first step in mitigating risks related to corporate renewable energy investments is identifying potential issues. This involves a comprehensive analysis of various factors, including market fluctuations, technological advancements, regulatory changes, and supply chain disruptions. Identifying these potential problems early allows for proactive risk management strategies to be implemented, minimizing the likelihood of negative impacts on the investment and operational efficiency of the renewable energy initiative.

Thorough research and due diligence are essential in this process. Analyzing historical data, current market trends, and potential future scenarios helps in identifying vulnerabilities and weaknesses in the proposed renewable energy project. This proactive approach allows the organization to anticipate and prepare for challenges, rather than reacting to them after they arise. Understanding the specific geographic location of the project, including local regulations and environmental factors, is also critical to identifying potential risks.

Assessing the Severity and Likelihood of Risks

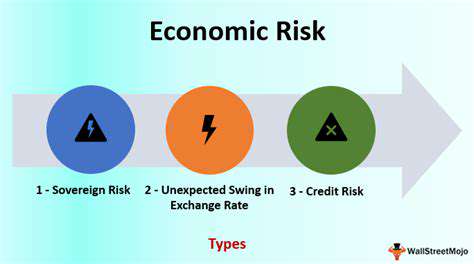

Once potential risks are identified, the next step is to assess their severity and likelihood. This involves evaluating the potential impact of each risk on the project's financial performance, operational efficiency, and reputation. Factors like the potential financial loss, the disruption to operations, and the damage to the company's image need to be considered.

A risk assessment matrix can be an effective tool in this process. This matrix categorizes risks based on their likelihood and potential impact, allowing for prioritization and focusing on the most critical issues. Understanding the probability of a risk occurring and the magnitude of its potential consequences enables a more informed decision-making process, leading to better allocation of resources and the development of appropriate mitigation strategies.

Assessing the likelihood of each risk involves considering historical data, expert opinions, and potential future scenarios. This step is crucial because it helps in prioritizing the risks and focusing efforts on those that pose the greatest threats to the project's success. For example, a risk with a high likelihood and high impact would require immediate attention and dedicated mitigation strategies, whereas a risk with a low likelihood and low impact might be monitored but not require significant intervention.

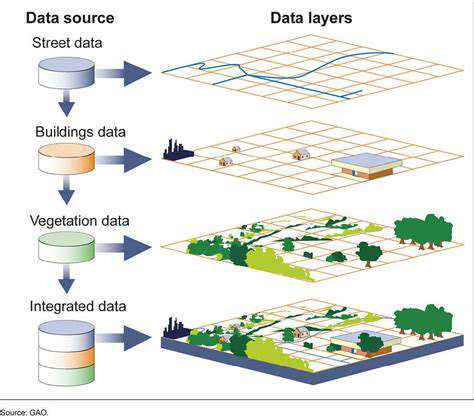

Consideration of dependencies, both internally and externally, is also vital in this assessment. Identifying how various components of the project rely on each other and external factors, such as supply chains, can reveal potential vulnerabilities. This holistic approach to risk assessment provides a more complete picture of potential challenges and allows for a more effective and comprehensive response.

By systematically evaluating the severity and likelihood of identified risks, organizations can develop targeted mitigation strategies that align with their overall business objectives and risk tolerance levels.

Supply Chain and Logistics Risks

Supply Chain Disruptions

Supply chain disruptions are a significant concern for businesses of all sizes. These disruptions can range from minor delays in delivery to complete halting of production, often triggered by unforeseen events like natural disasters, geopolitical instability, or pandemics. Understanding the potential vulnerabilities in your supply chain and implementing robust mitigation strategies is crucial for maintaining operational efficiency and minimizing financial losses. A well-prepared business will have contingency plans in place to respond effectively to various disruption scenarios, ensuring business continuity.

Geopolitical Risks

Geopolitical instability, including trade wars, sanctions, and political unrest, can create significant obstacles for global supply chains. These factors can lead to unpredictable changes in import/export regulations, tariffs, and transportation routes, often creating significant delays and increased costs for businesses.

The unpredictability of global events makes it difficult to fully mitigate these risks, but proactive strategies, such as diversifying supply sources and establishing contingency plans, can help mitigate the impact of geopolitical disruptions.

Inventory Management Risks

Inefficient inventory management can lead to significant financial strain and operational inefficiencies. Holding excessive inventory ties up capital that could be used for other purposes, while insufficient inventory can lead to lost sales and customer dissatisfaction. Maintaining optimal inventory levels requires careful forecasting, demand planning, and real-time tracking of inventory movements. Implementing inventory management software and employing data-driven decision-making processes are essential steps in optimizing inventory control.

Transportation and Infrastructure Risks

Transportation disruptions, whether due to weather events, infrastructure problems, or labor issues, can significantly impact the flow of goods. Delays, damage, and increased transportation costs are all potential consequences. Reliable transportation networks are essential for smooth operations, and businesses should consider factors such as route diversification, alternative modes of transportation, and resilience of infrastructure when planning their supply chains. Having contingency plans for transportation disruptions is crucial.

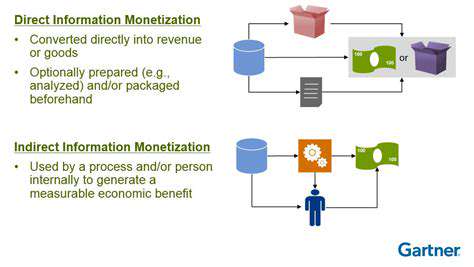

Financial Risks

Fluctuations in currency exchange rates, rising fuel costs, and unexpected increases in raw material prices can pose significant financial risks to supply chains. These external factors can lead to unexpected cost increases, impacting profitability and potentially threatening the viability of the business. Hedging strategies and careful financial planning are essential tools in managing these risks. Monitoring market trends and adapting pricing strategies accordingly are vital to mitigate the impact of these financial uncertainties.

Operational and Performance Risks

Operational Risks in Renewable Energy Projects

Operational risks in renewable energy projects encompass a broad spectrum of potential issues that can disrupt the smooth functioning of the project, impacting its performance and profitability. These risks often stem from unforeseen technical challenges, maintenance difficulties, and unexpected weather patterns. For example, a sudden drop in wind speed could severely impact the output of a wind farm, leading to financial losses and reputational damage if not adequately addressed in the project's operational plan.

Furthermore, issues related to personnel, supply chain disruptions, and regulatory changes can also fall under this category. Effective risk management requires a thorough understanding of these potential issues and the development of robust contingency plans to mitigate their impact.

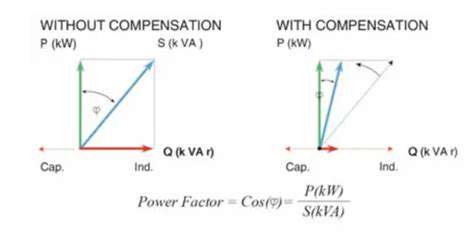

Performance Risks Associated with Technology

Technological advancements in renewable energy technologies are crucial for improving efficiency and reducing costs. However, these advancements are not always without their risks. Performance risks associated with new or evolving technologies can be substantial. For instance, a new solar panel design might perform poorly in specific weather conditions or require more maintenance than anticipated, leading to decreased energy production and increased operational costs.

Reliability of the technology is also a critical factor. If the technology experiences unexpected failures, it can significantly impact the project's overall performance and profitability. Thorough testing, validation, and ongoing monitoring are essential to mitigate these risks.

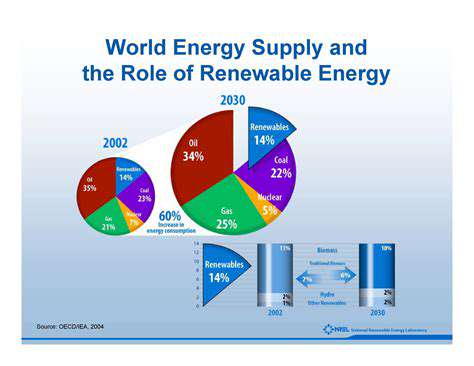

Financial Risks in Project Financing

Securing funding for renewable energy projects can be challenging, and the financial risks associated with project financing are significant. Fluctuations in interest rates, changes in government policies related to renewable energy incentives, and the overall economic climate can all impact the project's financial viability. A sudden shift in investor sentiment, for example, could significantly impact the project's ability to secure necessary financing at favorable terms.

Mismanagement of project budgets and potential cost overruns are also significant financial risks that need to be carefully considered and mitigated through robust financial planning and cost control measures.

Regulatory and Policy Risks

Changes in environmental regulations, renewable energy policies, and permitting processes can significantly impact the viability and profitability of renewable energy projects. Sudden shifts in policy direction, for example, could render a project uneconomical or even legally problematic if not proactively addressed. Thorough due diligence and ongoing monitoring of regulatory changes are critical for effective risk mitigation.

The regulatory landscape surrounding renewable energy can differ significantly between jurisdictions, requiring careful consideration of local regulations and potential conflicts.

Supply Chain Risks and Material Availability

Renewable energy projects rely heavily on a robust supply chain for raw materials, components, and services. Disruptions in the supply chain, including material shortages, price fluctuations, and geopolitical instability, can significantly impact project timelines and costs. For example, a sudden increase in the price of critical components like solar panels could significantly increase the project's budget, potentially impacting its profitability.

Diversification of supply sources and building strong relationships with reliable suppliers are essential strategies for mitigating these risks.

Community Acceptance and Stakeholder Engagement

Community acceptance and stakeholder engagement are often overlooked aspects of renewable energy projects, but they present significant operational and reputational risks. Negative public perception of a project, opposition from local communities, or disputes with neighboring landowners can significantly delay or even halt a project. Effective communication, stakeholder engagement, and transparent project planning are crucial for fostering community acceptance and managing potential conflicts.

Building trust and addressing concerns proactively can help prevent negative impacts and ensure the project's long-term sustainability.