Green Bonds and Corporate Renewable Investments

Understanding Green Bonds

Green bonds represent an innovative financial instrument, distinct from conventional debt securities due to their exclusive focus on funding ecologically beneficial initiatives. Unlike traditional bonds, these instruments mandate that all raised capital be allocated to ventures delivering measurable environmental benefits. This could span diverse sectors including clean energy generation, low-carbon transit systems, and advanced water conservation technologies. The dual appeal of financial returns and ecological impact makes these instruments particularly attractive to value-driven investors.

The fundamental purpose of these sustainable debt vehicles is to redirect investment capital toward planet-positive projects. They create a unique convergence point where financial objectives meet environmental stewardship, establishing themselves as a critical mechanism in global climate mitigation strategies. Rigorous disclosure requirements ensure bond issuers maintain complete transparency regarding fund allocation and environmental outcomes.

Types of Green Bond Projects

The application of green bond proceeds encompasses an ever-expanding spectrum of environmental initiatives. Current implementations range from utility-scale solar arrays and offshore wind installations to smart city infrastructure and regenerative agriculture programs. Each project must demonstrate verifiable alignment with predefined sustainability criteria, typically validated through third-party certification processes.

As technological advancements accelerate, the project pipeline continues diversifying. Emerging focus areas include green hydrogen production facilities, carbon capture storage systems, and circular economy innovations. This evolution reflects both market maturation and growing recognition of interconnected sustainability challenges across industries.

The Role of Corporate Renewable Energy in Green Bonds

Commercial entities increasingly leverage green bonds to finance their energy transition strategies. Major corporations utilize these instruments to fund distributed renewable generation assets, energy efficiency retrofits, and clean technology R&D. Beyond environmental benefits, such investments frequently yield operational cost savings while enhancing brand equity among sustainability-conscious stakeholders.

Investor Appeal and Market Growth

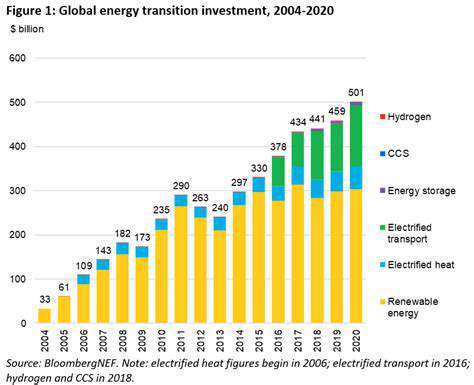

The green bond market has witnessed exponential growth as institutional investors recalibrate portfolios to reflect climate risk assessments. Pension funds and asset managers now routinely incorporate these instruments into their ESG-aligned investment strategies, recognizing their potential to deliver competitive returns while addressing systemic environmental challenges.

Market expansion continues outpacing projections, with issuance volumes doubling every 2-3 years. This trajectory suggests mainstream acceptance of sustainable finance principles and indicates growing sophistication among both issuers and investors regarding impact measurement methodologies.

The Importance of Transparency and Verification

Market integrity hinges on robust reporting frameworks and independent assurance mechanisms. Leading issuers now provide granular impact metrics, including avoided emissions calculations and renewable energy generation statistics. Third-party verifiers employ increasingly rigorous standards to evaluate project eligibility and monitor post-issuance compliance, addressing concerns about potential greenwashing.

Challenges and Future Outlook

While the market has achieved remarkable growth, persistent challenges include the need for harmonized taxonomies and standardized impact reporting protocols. Regulatory bodies worldwide are working to establish clearer guidelines that will further reduce ambiguity and enhance comparability across issuances. The accelerating pace of climate policy implementation suggests continued strong demand, with some analysts projecting the market could surpass $1 trillion in annual issuance by 2025.

Conclusion

These specialized debt instruments have proven their viability as catalysts for environmental progress. Their ability to mobilize private capital at scale positions them as indispensable tools for achieving net-zero commitments. As verification protocols become more sophisticated and investor confidence grows, these instruments will likely play an expanding role in financing the global sustainability transition.

Corporate Renewable Investments: Driving the Transition

Corporate Renewable Investments: Driving Sustainable Growth

Forward-thinking enterprises now recognize renewable energy investments as strategic imperatives rather than optional CSR initiatives. The business case has evolved beyond risk mitigation to encompass tangible competitive advantages, including energy price stability, supply chain resilience, and enhanced stakeholder relationships. This paradigm shift reflects deeper understanding of sustainability's role in long-term value creation.

Key Drivers Behind the Investment Surge

Multiple converging factors explain the dramatic uptick in corporate renewable commitments. Technological advancements have driven down clean energy costs by over 80% in the past decade, while carbon pricing mechanisms and renewable portfolio standards continue reshaping energy economics. Simultaneously, institutional investors are systematically reallocating capital toward companies demonstrating credible transition plans.

The emergence of climate-conscious consumer demographics represents another powerful market force, with purchasing decisions increasingly influenced by corporate sustainability performance. Regulatory developments like mandatory climate disclosures further reinforce the business imperative for renewable investment.

Investment Strategies and Opportunities

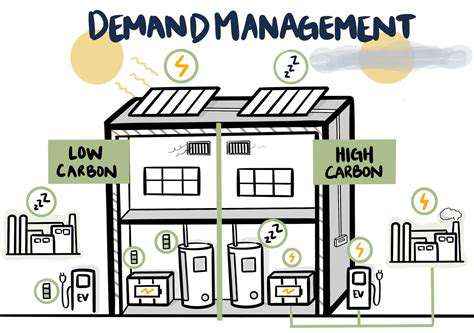

Corporate approaches to renewable deployment have grown increasingly sophisticated. Beyond traditional power purchase agreements, companies now explore innovative structures including green tariffs, virtual PPAs, and renewable energy certificates. Some industry leaders are establishing dedicated clean energy investment arms to capitalize on emerging technologies like floating offshore wind and next-generation energy storage.

Collaborative models are gaining traction, with competitors in some sectors forming renewable energy consortia to achieve scale efficiencies. Such partnerships demonstrate how sustainability priorities can transcend traditional market rivalries to address shared systemic challenges.

Challenges and Considerations

Implementation hurdles persist, particularly regarding grid interconnection queues and transmission infrastructure limitations. Supply chain volatility continues affecting project timelines, while evolving regulatory landscapes require continuous monitoring. Talent acquisition presents another critical challenge, as demand for renewable energy expertise outpaces workforce development in many markets.

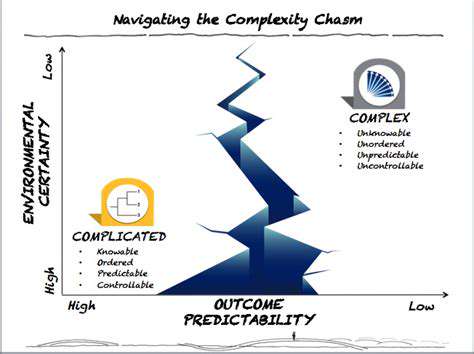

Successful navigation of these complexities requires cross-functional coordination, integrating sustainability objectives with core business strategy, risk management frameworks, and capital allocation processes. Leading organizations are establishing renewable energy task forces that combine technical, financial, and legal expertise to optimize investment outcomes.