Virtual PPAs: A Flexible Path for Corporate Renewable Procurement

Key Benefits of Virtual PPAs

Enhanced Flexibility and Scalability

Businesses today face rapidly changing energy demands, and virtual PPAs provide unmatched adaptability compared to traditional power purchase agreements. Companies can dynamically adjust their renewable energy commitments based on real-time operational needs, production fluctuations, or market conditions. This flexibility proves particularly valuable for industries with seasonal variations or those undergoing expansion.

Cost-Effectiveness and Predictability

The financial advantages of virtual PPAs make them attractive for organizations of all sizes. By eliminating physical infrastructure requirements, companies avoid substantial capital expenditures while still supporting renewable energy projects. The predictable pricing structures help financial teams create accurate long-term budgets, especially valuable in volatile energy markets.

Streamlined Procurement Processes

Traditional energy contracts often involve complex negotiations and lengthy implementation timelines. Virtual PPAs simplify this significantly, with reduced paperwork and faster execution times. The digital nature of these agreements allows companies to focus resources on core business operations rather than energy procurement logistics.

Improved Environmental Impact

Corporate sustainability goals become more achievable through virtual PPAs. These agreements directly support renewable energy generation, helping companies reduce their carbon footprint without requiring on-site renewable installations. The environmental benefits extend beyond simple carbon accounting to supporting broader renewable energy infrastructure development.

Reduced Capital Expenditure

Financial officers appreciate how virtual PPAs minimize upfront costs. Unlike traditional energy projects requiring major investments, virtual agreements operate on an operational expense model, preserving capital for other strategic initiatives. This makes renewable energy accessible even to mid-sized enterprises.

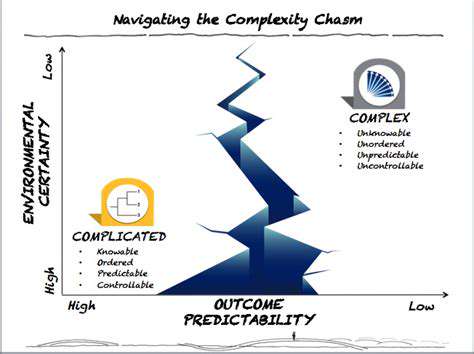

Improved Risk Management

The distributed nature of virtual PPAs creates inherent risk mitigation. Companies avoid dependence on single energy sources or locations, protecting against regional disruptions or price volatility. The flexibility to adjust commitments provides additional protection against changing market conditions.

Tailoring Virtual PPAs to Specific Needs

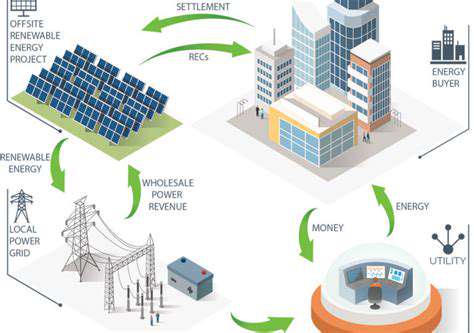

Understanding the Core Concept

Virtual PPAs represent a fundamental shift in energy procurement, allowing companies to support renewable generation without physical energy delivery. These financial contracts enable organizations to purchase renewable energy certificates (RECs) that verify their clean energy usage, regardless of their physical location or grid connection.

Custom Solutions for Different Industries

Manufacturers benefit from virtual PPAs by stabilizing energy costs for production facilities. Tech companies leverage them to meet sustainability targets for data centers. Each industry requires unique contract structures to align with their specific energy consumption patterns and corporate goals.

Geographical Flexibility

Unlike traditional PPAs tied to specific locations, virtual agreements allow companies to support projects in optimal renewable energy regions, even if those areas don't match their physical operations. This maximizes both environmental impact and often financial returns.

Scalable Implementation

Organizations can start small with virtual PPAs and expand commitments gradually. This phased approach lets companies gain experience with renewable procurement before making larger commitments, reducing implementation risk.

Integration with Existing Energy Strategies

Virtual PPAs complement rather than replace current energy contracts. Companies can maintain existing utility relationships while layering renewable commitments through virtual agreements, creating a balanced transition strategy.

Regulatory Compliance Advantages

In regions with renewable portfolio standards or carbon regulations, virtual PPAs provide verifiable documentation of clean energy usage, helping companies meet compliance requirements more efficiently than through traditional means.

The Future of Corporate Renewable Procurement

Market Growth and Evolution

The virtual PPA market continues expanding as more companies commit to renewable energy targets. Innovative contract structures are emerging to accommodate different risk appetites and financial models, making these agreements accessible to broader business segments.

Technology Integration

Advanced analytics and blockchain applications are beginning to transform virtual PPAs. These technologies enable real-time tracking of renewable energy impacts and more transparent REC accounting, increasing confidence in these instruments.

Global Expansion

While initially concentrated in certain markets, virtual PPAs are gaining traction worldwide. Developing standardized frameworks will be crucial for facilitating cross-border renewable energy transactions and supporting global corporate sustainability initiatives.

Community Impact Potential

Virtual PPAs create opportunities to support smaller, community-based renewable projects that might otherwise struggle to find financing. This distributed approach can democratize renewable energy development while providing corporations with diversified renewable portfolios.

Strategic Business Advantage

Forward-thinking companies recognize virtual PPAs as more than sustainability tools - they represent competitive differentiators in talent acquisition, customer perception, and investor relations. The business case extends well beyond simple energy cost considerations.