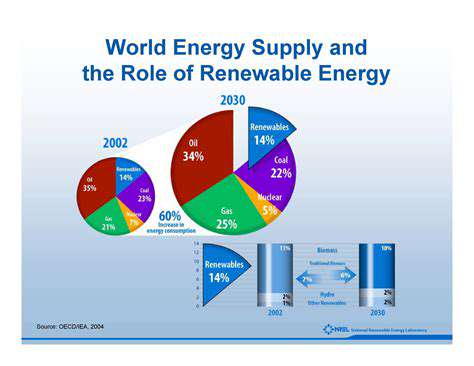

The Role of Government Subsidies and Tax Credits in Renewable Energy Finance

The Crucial Role of Financial Support

The Significance of Capital Investment

Capital investment serves as the backbone of economic expansion and technological advancement. Enterprises need significant monetary injections to procure cutting-edge machinery, modernize aging facilities, and scale their market presence. These expenditures directly correlate with enhanced output, streamlined processes, and ultimately, greater profitability. Well-crafted capital investment approaches remain indispensable for enduring viability in our rapidly evolving commercial landscape.

Moreover, such investments spark employment generation. New ventures and operational growth consistently demand skilled personnel, triggering beneficial economic reverberations. This employment surge amplifies consumer expenditure, initiating a self-reinforcing cycle of financial activity.

Financial Support for Entrepreneurs

Aspiring business founders frequently encounter formidable obstacles when seeking startup capital. Reliable funding avenues prove absolutely vital for their survival and the regional economic vitality. Public sector programs, investment consortiums, and individual backers can offer crucial capital infusion along with valuable mentorship.

Such assistance doesn't merely help launch enterprises but also cultivates inventive solutions and employment prospects. By equipping entrepreneurs with resources, we cultivate a more dynamic and resilient economic ecosystem.

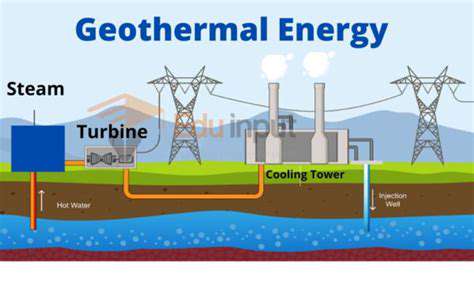

Funding for Infrastructure Development

Contemporary infrastructure systems - including transit networks, digital connectivity, and power distribution - form the bedrock of economic success. Proper resourcing for infrastructure projects remains paramount for sustaining economic momentum and elevating living standards. These undertakings simultaneously create employment while boosting operational effectiveness and commercial exchange.

Superior infrastructure serves as the cornerstone for economic robustness. It enables companies to function optimally, improves regional accessibility, and facilitates seamless goods movement. These advantages collectively foster a more competitive national economy.

Addressing Financial Needs of Vulnerable Populations

Financial assistance extends beyond corporate interests to include economically disadvantaged groups. Offering reasonable loan options, money management education, and small-scale financing can enable individuals and households to enhance their financial circumstances. Such initiatives possess the potential to interrupt poverty cycles while encouraging social integration.

Precision-targeted financial aid for marginalized groups can dramatically transform lives, promoting autonomy and economic resilience. This approach contributes to building a fairer and more inclusive society.

Impact on Economic Growth and Stability

Sufficient financial backing proves essential for preserving economic expansion and steadiness. When enterprises and citizens enjoy ready access to capital, they demonstrate greater willingness to invest, develop innovations, and generate employment. This subsequently invigorates economic dynamics and raises overall national prosperity.

Consistent and transparent financial systems remain fundamental for nurturing confidence and attracting sustained investments. Such stability proves critical for achieving durable economic progress while mitigating recessionary risks.

The Role of Government in Financial Support

Public authorities maintain a crucial position in financing diverse economic sectors. Policy frameworks and assistance programs can stimulate investment, encourage business creation, and support financially vulnerable demographics. Calculated investments in public works, educational systems, and medical services establish favorable conditions for economic advancement.

Strategic government interventions can jumpstart economic processes and employment generation, eventually benefiting the broader community. However, program efficacy hinges on meticulous preparation, unambiguous execution, and rigorous oversight.

Addressing Challenges and Optimizing Effectiveness

Identifying and Defining the Problem

While designed to stimulate economic sectors, government subsidies occasionally produce counterproductive outcomes. Recognizing specific subsidy-related challenges - including market distortion risks, dependency creation, or beneficiary targeting issues - proves essential for maximizing program efficiency. This necessitates thorough examination of available information and stakeholder viewpoints prior to subsidy implementation or adjustment.

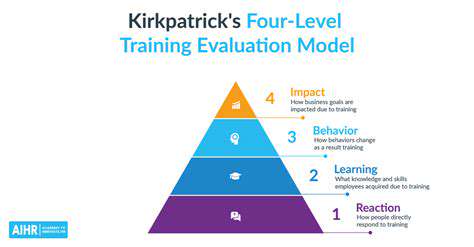

Assessing the Impact of Existing Subsidies

Evaluating current subsidy outcomes represents the foundational step toward optimization. This process requires comprehensive data analysis regarding program results, considering both anticipated and unexpected consequences. Are subsidies meeting their objectives? Are there adverse effects like market interference or resource misallocation? Historical program reviews can yield valuable lessons regarding effective practices and potential pitfalls, informing future policy decisions.

Targeting Subsidies Effectively

Precise beneficiary identification presents a persistent subsidy program challenge. Inaccurate targeting results in resource wastage and diminished impact. Establishing unambiguous eligibility standards and verification protocols remains imperative. Potential solutions include utilizing existing databases, conducting targeted outreach, or implementing rigorous authentication procedures to ensure proper fund allocation.

Minimizing Inefficiencies and Waste

Subsidy programs frequently encounter efficiency challenges including bureaucratic overhead, transparency deficits, and potential misuse. Reducing these issues demands thoughtful program architecture featuring simplified administration, clear responsibility assignments, and comprehensive monitoring frameworks. Such measures help guarantee appropriate use of public funds while achieving policy objectives.

Exploring Alternative Policy Instruments

While subsidies represent common policy tools, alternative approaches may sometimes prove superior. Tax benefits, direct grants, or service provision might achieve comparable or better outcomes with fewer negative externalities. Context-specific evaluation remains essential for determining optimal policy mechanisms.

Promoting Transparency and Accountability

Openness and responsibility constitute fundamental principles for maintaining public subsidy confidence. Clear explanation of program purposes, structures, and results helps citizens understand fiscal allocations. Implementing standardized reporting and independent assessments builds accountability while enabling data-driven program refinement.

Encouraging Private Sector Participation

Strategic private sector collaboration can frequently enhance subsidy effectiveness. By combining governmental resources with corporate expertise, programs can achieve greater efficiency and innovation. These cooperative ventures often yield superior outcomes compared to unilateral government initiatives.