Corporate Renewable Procurement and ESG

The Rise of Renewable Energy Procurement in Corporate Strategies

Driving Forces Behind the Shift

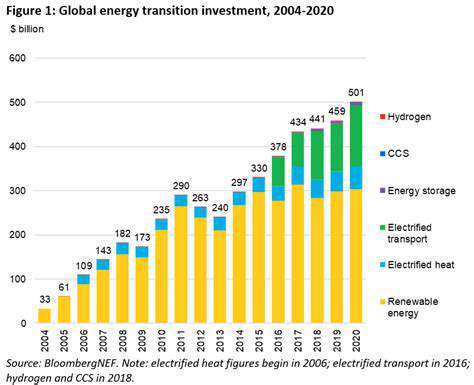

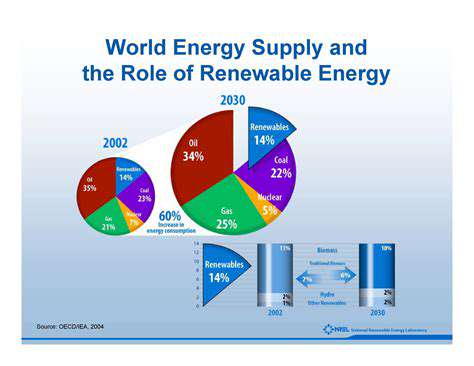

Corporate renewable energy procurement has become a cornerstone of modern business strategy due to multiple converging factors. Environmental stewardship now sits at the heart of corporate decision-making as organizations acknowledge their critical role in addressing climate challenges. The financial sector's growing emphasis on sustainability metrics has created unprecedented pressure for companies to adopt green energy solutions, transforming what was once optional into a business imperative. While ethical considerations drive part of this movement, pragmatic financial benefits are equally compelling - particularly as renewable technology costs plummet and traditional energy markets remain unstable.

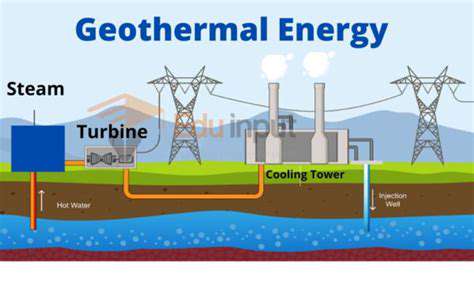

Policy frameworks worldwide are accelerating this transformation. Governments are implementing sophisticated incentive structures, from tax credits to renewable portfolio standards, making clean energy adoption financially attractive. Carbon pricing mechanisms have fundamentally altered the economic calculus, turning emissions reduction into a balance sheet consideration rather than just corporate social responsibility. Technological advancements in energy storage and smart grid integration have removed previous barriers, enabling seamless incorporation of renewables into existing infrastructure. This perfect storm of regulatory, technological, and market forces makes renewable procurement not just viable but essential for forward-thinking corporations.

Benefits and Implications for Businesses

The strategic shift toward renewable energy delivers multifaceted advantages that extend far beyond environmental benefits. Companies locking in long-term power purchase agreements (PPAs) frequently achieve significant cost predictability, insulating themselves from fossil fuel price volatility. This financial stability proves particularly valuable in economic downturns when energy costs typically spike. Brand differentiation represents another critical advantage, as consumers increasingly vote with their wallets for environmentally responsible companies. Employee recruitment and retention metrics consistently show stronger performance among sustainability leaders, creating a tangible human capital advantage.

Transition challenges, while real, often prove temporary. Although upfront capital requirements can appear daunting, innovative financing models like green bonds and third-party ownership structures have democratized access. Grid integration complexities have diminished with advanced energy management systems that optimize renewable utilization. While intermittency concerns persist in some regions, hybrid systems combining solar, wind, and storage now deliver reliability matching traditional baseload power. The long-term value proposition overwhelmingly favors early adopters, as renewable infrastructure typically offers decades of stable, low-maintenance operation.

The broader implications of this corporate energy revolution are profound. Entire new industries have emerged around renewable technology development and deployment, creating millions of high-quality jobs globally. Local communities benefit from improved air quality and reduced environmental degradation. Perhaps most significantly, corporate procurement has become the primary driver of renewable energy growth worldwide - proving that environmental responsibility and business success aren't mutually exclusive but fundamentally interconnected.

Quantifying the Financial and Environmental Impacts

Quantifying Financial Impact

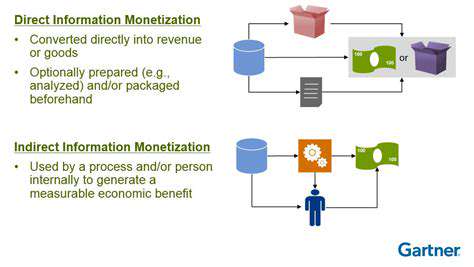

Modern financial analysis frameworks now incorporate sophisticated modeling to evaluate sustainability initiatives. Beyond simple payback periods, lifecycle cost analysis reveals the true value proposition of renewable investments, accounting for maintenance savings, tax incentives, and avoided compliance costs. Progressive organizations utilize scenario planning to model various energy price trajectories, demonstrating how renewables provide an effective hedge against market volatility. The most advanced analyses now incorporate reputational value and brand equity impacts, recognizing that sustainability directly influences customer acquisition costs and market share.

Environmental Impact Assessment

Contemporary environmental assessments have evolved into comprehensive sustainability audits. Modern methodologies quantify ecosystem services with monetary precision, assigning concrete value to factors like carbon sequestration and biodiversity preservation. Leading corporations employ geographic information systems (GIS) to model micro-level environmental impacts, enabling hyper-localized mitigation strategies. The most progressive firms conduct parallel assessments of social impacts, recognizing that environmental and community health are inextricably linked.

Regulatory Compliance

The regulatory landscape has become increasingly dynamic, with jurisdictions worldwide implementing aggressive decarbonization targets. Proactive compliance strategies now yield competitive advantages, as early adopters avoid costly retrofits when standards tighten. Innovative companies establish regulatory affairs teams that actively participate in policy development, helping shape future requirements to align with technological realities. This forward-looking approach transforms compliance from a cost center into a strategic differentiator.

Stakeholder Engagement

Twenty-first century stakeholder engagement requires multi-channel communication strategies. Digital platforms enable real-time dialogue with communities, while advanced analytics help identify and prioritize stakeholder concerns. The most effective programs co-create solutions with local stakeholders, resulting in initiatives that deliver mutual environmental and economic benefits. This collaborative approach frequently uncovers innovative partnerships that enhance project viability and social license to operate.

Resource Management

Next-generation resource management leverages IoT sensors and AI-driven analytics to optimize consumption patterns. Closed-loop systems are redefining industrial processes, transforming waste streams into revenue sources. Digital twin technology allows for virtual testing of resource efficiency strategies before implementation, significantly reducing trial-and-error costs. These advancements make sustainable operations not just environmentally preferable but operationally superior.

Supply Chain Considerations and Collaboration

Supply Chain Mapping and Transparency

Modern supply chain analysis requires blockchain-enabled traceability systems that provide immutable records of environmental impacts at every production stage. Advanced analytics platforms now correlate procurement data with sustainability metrics, enabling data-driven decision making across global supplier networks. This technological revolution has made previously opaque supply chains transparent, allowing for precise carbon accounting and targeted improvement initiatives.

Collaboration and Partnerships for Renewable Energy

The renewable energy transition has spawned innovative partnership models. Consortium-based power purchasing agreements now enable smaller firms to achieve economies of scale previously only available to multinational corporations. Digital collaboration platforms facilitate knowledge sharing across industries, accelerating the diffusion of best practices. Perhaps most significantly, cross-sector partnerships are developing integrated renewable solutions that optimize energy systems across entire value chains.

Supply Chain Resilience and Risk Mitigation

Renewable-integrated supply chains demonstrate remarkable resilience during disruptions. Distributed energy resources provide operational continuity during grid instability, while diversified sourcing strategies reduce concentration risk. Advanced risk modeling now incorporates climate scenarios, enabling proactive adaptation to changing environmental conditions. These strategies collectively create supply networks that are both environmentally sustainable and operationally robust.