Solar Panel Depreciation and Tax Benefits for Homeowners

Understanding Solar Panel Depreciation

Solar panel depreciation, like other property investments, is a crucial aspect of owning solar panels. It essentially involves the gradual decrease in the value of your solar panels over time. This is a common accounting practice for assets that lose value due to wear and tear, obsolescence, or other factors. Understanding the depreciation process allows homeowners to accurately account for the cost of their solar panels on their tax returns and to better manage their financial projections for the life of the system.

Methods of Depreciation for Solar Panels

Several methods exist for calculating depreciation, each with its own implications for tax purposes. The most common method for solar panels, as with many other assets, is the straight-line method. This method spreads the depreciable cost of the solar panels evenly over their estimated useful life. Other methods, such as the declining balance method, might accelerate the depreciation process, leading to higher deductions in the early years but potentially lower deductions later on. It's crucial to consult with a tax professional to determine the best depreciation method for your specific situation and to ensure compliance with tax regulations.

Tax Implications of Solar Panel Depreciation

Depreciating your solar panels can significantly impact your tax liability. By deducting the depreciation expense, you reduce the taxable income associated with your solar panel investment. This can lead to substantial savings on your annual tax bill. However, the specific tax implications vary depending on your location, the type of solar panel system, and the applicable tax laws. It's essential to consult with a tax advisor to understand the precise tax benefits and ensure you comply with all relevant regulations.

Factors Affecting Solar Panel Depreciation

Several factors can influence the depreciation of your solar panels. The useful life of the solar panels, as determined by manufacturer specifications and industry standards, is a primary consideration. Additionally, technological advancements and changes in energy efficiency standards can impact the perceived value of the panels over time. Economic conditions, particularly fluctuations in energy costs, can also influence the perceived value of solar panel systems and the potential tax benefits associated with depreciation.

Depreciation Schedules and Record-Keeping

Maintaining accurate records of your solar panel installation, including the purchase date, cost, and estimated useful life, is critical for calculating depreciation. Using depreciation schedules, which outline the annual depreciation expense, allows you to systematically track the value reduction of your solar panel system. Thorough record-keeping is essential for accurately reporting your depreciation expenses to the appropriate tax authorities and for ensuring compliance with tax laws. This diligent record-keeping can also help you track the actual performance of your solar panel system over time.

Tax Credits and Incentives for Solar Energy Systems

Federal Tax Credits

The primary federal tax incentive for solar energy systems is the Investment Tax Credit (ITC). This credit allows homeowners and businesses to claim a significant portion of the cost of new solar panels and associated equipment as a tax credit. The ITC has historically offered substantial savings, and understanding the specific rules and eligibility requirements is crucial for maximizing the financial benefits of going solar. The credit percentage has varied over time, and current legislation and future changes should be monitored to ensure optimal savings. The ITC is a powerful tool to reduce the upfront cost of a solar energy system.

Beyond the ITC, there may be additional federal tax deductions and credits available depending on specific circumstances and the type of solar energy system installed. These can include credits for certain energy efficiency improvements in conjunction with solar installations or other programs focused on renewable energy. Consult with a tax professional or qualified advisor to determine if you qualify for any additional federal incentives.

State and Local Incentives

Many states and localities offer their own incentives and rebates to encourage the adoption of solar energy. These incentives can vary significantly depending on the state and may include property tax exemptions, rebates, or credits for installation costs. Researching the specific incentives in your area is essential to understand the full financial picture. State incentives often complement the federal ITC and can result in substantial savings for homeowners and businesses investing in solar energy.

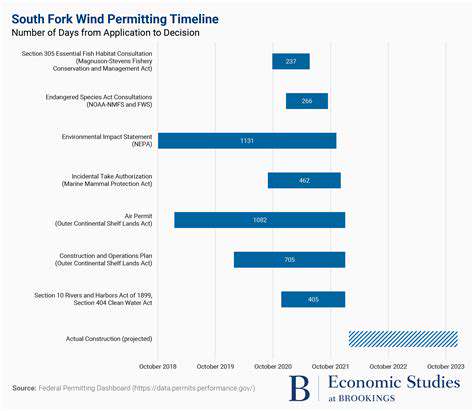

Accessing these state and local incentives often involves specific procedures and forms. The process can vary from state to state, and it's crucial to understand the precise requirements to ensure a smooth application and claim process. Thorough research and communication with local authorities or solar installers are key to navigating these incentives effectively.

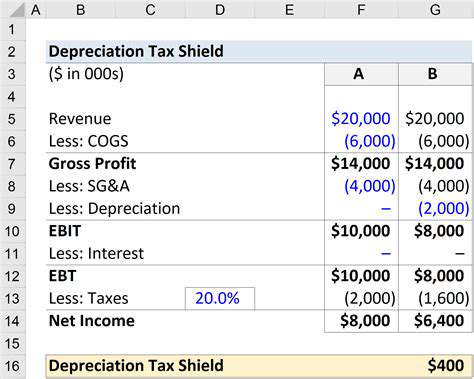

Depreciation and Amortization

While not a direct tax credit, depreciation and amortization can impact the overall financial benefits of a solar energy system. Depreciation allows businesses to gradually deduct the cost of the solar investment over several years. This can lead to substantial tax savings over the system's lifespan. Understanding the depreciation schedule and the specific rules for solar energy systems is crucial to properly account for this benefit.

Amortization, in some contexts, may also be relevant for solar investments, particularly for businesses. This method of accounting can provide a structured approach to spreading the cost of the solar system over time, which can influence financial planning and tax calculations. Different methods of depreciation and amortization can yield varying results, so it's important to consult with tax advisors to understand the most beneficial approach.

Other Considerations

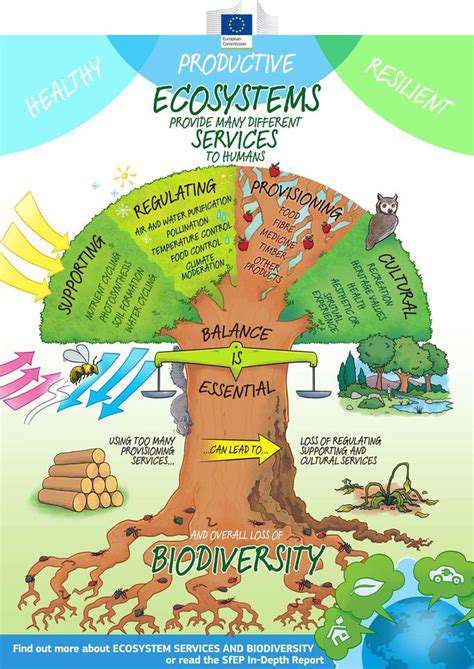

The financial aspects of solar energy systems extend beyond just tax credits and incentives. Factors like potential net metering programs and the generation of renewable energy certificates (RECs) can also contribute to the overall economic viability of solar energy. These aspects should be considered in conjunction with tax incentives to fully assess the return on investment for solar installations.

Additionally, the overall cost of the project, including installation, permitting, and any necessary upgrades, should be carefully factored into the financial analysis. A comprehensive review of all financial components, including the long-term operational costs of the system, is essential for making an informed decision.