How to Finance a Community Microgrid Project

Exploring Private Sector Investment Options

Private Sector Investment Strategies

Investing in the private sector involves diverse approaches, including venture capital, private equity, direct lending, and real estate investment trusts. Each method presents unique risks and rewards, necessitating careful analysis and a deep grasp of market dynamics to achieve favorable outcomes. Tailoring investment strategies to individual financial goals remains a cornerstone of successful private sector engagement. Such investments often demand substantial capital and a long-term perspective, requiring patience to weather market volatility.

Private sector investments frequently target non-public entities like startups, established firms, real estate, or infrastructure projects. While these opportunities may yield higher returns than public markets, they also carry elevated risk levels. Conducting thorough due diligence and developing sector-specific expertise are vital for minimizing risks while optimizing potential gains.

Factors Influencing Investment Decisions

Multiple elements shape private investment choices. Economic indicators such as interest rates, inflation trends, and broader market conditions significantly influence potential returns. Sector-specific knowledge—whether in technology, healthcare, or green energy—enables investors to better evaluate growth prospects and profitability.

Management quality represents another crucial consideration. Teams with proven success records, clear strategic visions, and operational competence typically inspire greater confidence. A well-structured business plan with achievable projections serves as a reliable indicator of an investment's long-term potential. Additionally, analyzing competitive positioning and innovation potential helps inform sound investment decisions.

Risks and Rewards of Private Sector Investments

Although private investments can deliver superior returns, they inherently involve greater risk exposure. Market instability, economic contractions, and unexpected events can dramatically affect investment valuations. Comprehensive risk assessment and mitigation planning become essential components of any private investment strategy.

Portfolio diversification across multiple asset classes and investment approaches represents a fundamental risk management technique. Combining different private investment types helps buffer against underperformance in any single holding. Investors should also recognize the potential liquidity constraints characteristic of many private market investments.

The Future of Private Sector Investment

Technological innovation, shifting investor priorities, and global economic transformations continue to reshape private investment landscapes. The expanding appetite for alternative assets and ongoing digital disruption are creating new paradigms for private capital deployment.

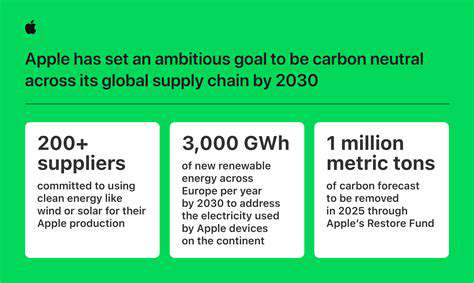

Sustainability considerations and ESG (Environmental, Social, and Governance) factors now significantly influence investment decision-making. Investors increasingly seek opportunities that generate both financial returns and positive societal impact. This trend appears likely to intensify, while improved investment platforms and analytical tools enhance market accessibility and transparency.

Creating a Compelling Business Plan

Understanding the Project's Financial Needs

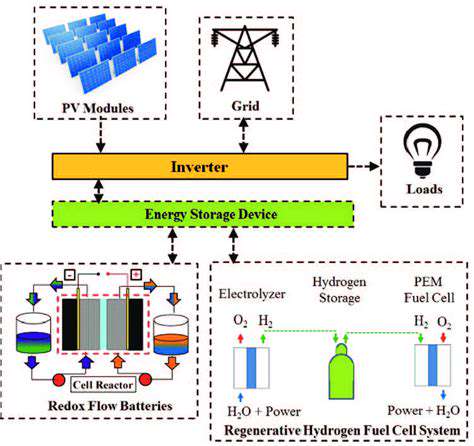

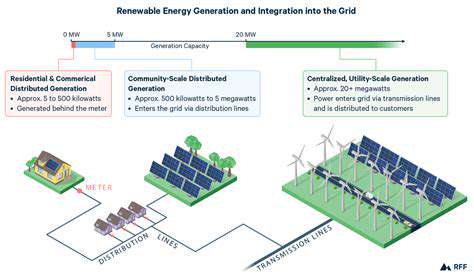

Developing a robust microgrid business plan begins with detailed financial assessment. Beyond initial capital costs for equipment and installation, planners must account for ongoing operational expenses, maintenance requirements, and revenue generation potential. Comprehensive feasibility studies should itemize all anticipated expenditures, including land procurement, grid interconnection fees, and renewable energy components. Precise cost breakdowns prove essential for demonstrating financial feasibility to potential funders.

Operational cost projections—covering staffing, maintenance agreements, and energy management systems—require equal attention. Incorporating potential energy price variations and regulatory changes strengthens the financial model's resilience and adaptability.

Developing Realistic Revenue Projections

Effective microgrid business plans must establish convincing revenue models. Potential income streams might include surplus energy sales, participation in energy markets, or innovative pricing structures that encourage efficient energy use.

Community-focused revenue opportunities deserve special consideration. Establishing energy cooperatives or offering efficiency incentives can generate income while advancing environmental objectives. The business plan should clearly quantify these potential revenue sources and their expected contributions to overall financial sustainability.

Securing Funding Sources

Identifying appropriate financing mechanisms represents a critical success factor for microgrid initiatives. Most projects combine multiple funding streams, including government grants, institutional loans, and community investment programs. Renewable energy-focused public funding opportunities can substantially reduce financial burdens.

Each funding source carries specific eligibility requirements that must be thoroughly understood. Crafting a persuasive narrative that emphasizes both financial viability and community benefits improves fundraising success with philanthropic organizations and public agencies.

Creating a Budget and Cash Flow Forecast

A meticulously constructed budget forms the financial foundation for any microgrid project. This document should specify all projected expenses and revenues with corresponding timelines, enabling precise financial tracking. Detailed cash flow projections allow for proactive financial management and anticipation of potential liquidity challenges throughout the project lifecycle.

Regular financial reviews and updates help maintain control and facilitate adjustments in response to changing circumstances. This disciplined approach minimizes financial surprises and keeps projects aligned with their economic objectives. Clear financial visibility also supports decisions regarding additional fundraising or resource reallocation.

Building a Strong Financial Management Team

Successful microgrid implementation requires dedicated financial expertise. The management team should possess strong capabilities in financial planning, budgeting, and cash flow analysis. Beyond technical skills, effective communication with diverse stakeholders—including community members—proves equally important.

The financial team must maintain clear understanding of project goals while remaining responsive to market changes. Their responsibilities include establishing financial controls and ensuring transactional transparency. A competent financial team builds stakeholder confidence and contributes significantly to long-term project success.