Presenting the Strategic Imperative of Renewable Energy to Your Board

Addressing Potential Risks and Challenges: Proactive Risk Management

Assessing the Landscape of Potential Threats

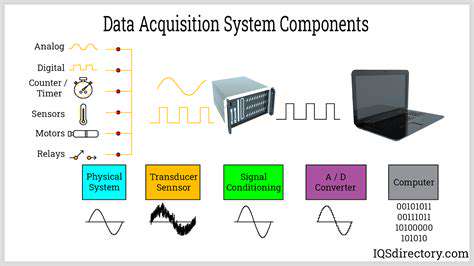

Identifying and categorizing potential risks is crucial for developing effective mitigation strategies. This involves a thorough examination of the internal and external factors that could negatively impact the project or organization. Analyzing current market trends and competitor activities provides valuable insights into potential challenges. A comprehensive risk assessment should also consider emerging technologies and regulatory changes that could create unforeseen obstacles.

A key element of this assessment is the identification of potential vulnerabilities. These vulnerabilities represent weak points in the system or process that could be exploited by external threats or internal errors. Understanding these vulnerabilities allows for the development of targeted risk mitigation strategies.

Developing Mitigation Strategies

Once potential risks have been identified, it's essential to develop effective mitigation strategies. This involves creating plans to address each identified risk, outlining specific actions to reduce the likelihood or impact of the threat. These strategies must be tailored to the specific risk and its potential consequences, ensuring a proportionate response.

A crucial aspect of developing mitigation strategies is considering the potential financial implications of each risk. Quantifying the potential losses associated with each risk allows for a more informed decision-making process in prioritizing mitigation efforts. This process helps to allocate resources effectively and ensure a balanced approach to risk management.

Implementing and Monitoring Controls

Implementing the developed mitigation strategies requires a structured approach, ensuring that the controls are effectively integrated into the existing processes. This step involves clear communication to all stakeholders, training on new procedures, and regular monitoring to ensure the effectiveness of the implemented controls.

Regular monitoring and evaluation are essential to ensure that the mitigation strategies remain effective over time. This process involves tracking key performance indicators (KPIs) and making adjustments as needed to adapt to evolving circumstances. Adaptability is key to ensuring long-term success in managing potential risks. This process also allows for continuous improvement in risk management procedures.

Ensuring Communication and Collaboration

Effective risk management relies heavily on open communication and collaboration among all stakeholders. This includes clearly communicating the identified risks and the implemented mitigation strategies to relevant teams and individuals. This ensures that everyone understands their roles and responsibilities in mitigating potential risks. Transparency and clear communication are fundamental to building trust and encouraging a collaborative approach to risk management.

Establishing clear lines of communication and collaboration ensures that any emerging risks are promptly identified and addressed. This proactive approach minimizes the potential for unforeseen consequences and allows for a more agile response to potential disruptions.

Money-related stress extends beyond account balances; it's an intricate emotional reaction influenced by various elements. These concerns frequently originate from previous encounters, including financial struggles or perceived shortcomings. Societal norms and expectations also play a role, as people often feel pressured to uphold particular lifestyles or reach specific milestones, resulting in stress and self-doubt.

Securing Board Buy-in: A Collaborative Approach to Decision-Making

Understanding the Board's Perspective

Boards of directors are ultimately responsible for the strategic success and long-term viability of an organization. Their decisions often have significant implications for the company's future, and they need to be confident that any proposed initiative is well-thought-out, aligned with the overall strategy, and likely to deliver positive outcomes. Understanding this perspective is crucial for securing board buy-in. They are not just rubber-stamping proposals; they are evaluating the potential risks and rewards, often with a long-term vision in mind.

It's essential to present information that resonates with their concerns and priorities. This involves demonstrating a clear understanding of the current market landscape, the competitive environment, and the potential impact of the proposed initiatives on the organization's financial performance and reputation. A well-prepared presentation will address potential objections and demonstrate that the initiative is a sound investment.

Clearly Defining the Problem

Before proposing a solution, it's critical to clearly define the problem that the initiative aims to address. This involves identifying the root causes of the issue and quantifying the negative impact it has on the organization. Providing data and evidence to support the problem statement is key to demonstrating the need for action.

Thorough research and analysis are vital to paint a comprehensive picture of the problem. This will help the board understand the scope and urgency of the situation and why the proposed solution is necessary.

Articulating a Compelling Solution

The proposed solution must be presented in a clear, concise, and logical manner. It should clearly outline the steps involved, the resources required, and the expected outcomes. The presentation should demonstrate a clear understanding of the potential challenges and how they will be addressed.

Highlighting the potential benefits of the solution, both tangible and intangible, is also crucial. Quantify the expected improvements in efficiency, cost savings, revenue generation, or other key performance indicators (KPIs) to demonstrate a strong return on investment.

Building a Strong Case for Investment

A compelling case for investment must go beyond simply stating the problem and solution. It needs to demonstrate a clear understanding of the financial implications, the potential risks, and the projected return on investment (ROI). Providing financial projections and scenario analysis can be helpful to illustrate the potential impact of the initiative on the organization's bottom line.

Highlighting Key Success Factors

A critical component of securing board buy-in is identifying and articulating the key success factors for the initiative. This involves outlining the critical milestones, key performance indicators (KPIs), and metrics that will be used to track progress. Demonstrating a proactive approach to managing potential risks is also essential for fostering confidence.

This section should clearly outline the steps involved in monitoring progress, assessing performance, and making adjustments as needed. It should also outline the communication plan for keeping the board informed throughout the process.

Ensuring Open Communication and Collaboration

Open communication and collaboration are essential throughout the process. Regular updates and transparent communication with the board are crucial for building trust and ensuring that they are kept informed of any significant developments or changes. Actively soliciting feedback and addressing concerns promptly is critical to fostering a collaborative environment.

Creating opportunities for the board to ask questions, provide input, and participate in discussions will demonstrate that their input is valued and that their perspectives are considered.