The Secondary Market for Renewable Energy Assets

Challenges and Considerations for Investors

Understanding Market Volatility

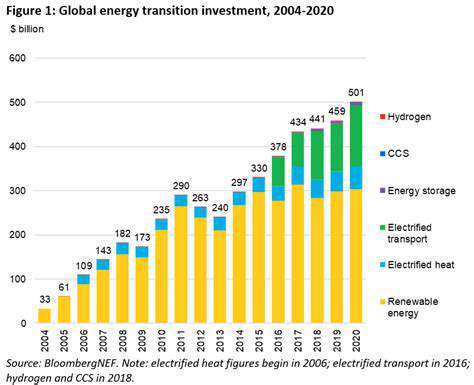

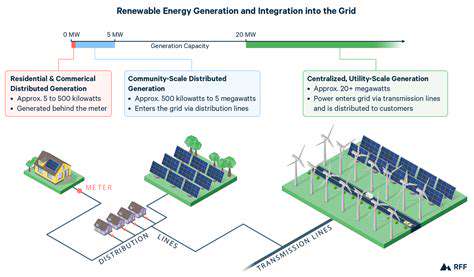

Renewable energy secondary markets offer return potential but experience inherent volatility. Commodity price swings, regulatory changes, and technological progress significantly impact asset values. Investors require thorough understanding of these forces to manage risks and capitalize on opportunities. This necessitates careful analysis and long-term strategies rather than short-term speculation.

Examining historical patterns and current trends proves critical for risk assessment. Investors should evaluate specific asset characteristics including technology type, project location, and contractual arrangements.

Assessing Project Risk and Due Diligence

Comprehensive evaluation becomes paramount when analyzing renewable energy projects. This involves examining technical feasibility, financial performance, and legal structures. Understanding location specifics, permitting status, and environmental implications proves essential. Investors must also assess developer and operator experience and reputation.

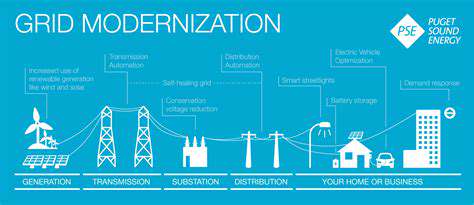

Evaluating overall risk profiles remains crucial. Factors like grid connectivity issues, permitting delays, and energy price fluctuations all contribute to risk. Investors must consider potential unforeseen events and their financial impact.

Navigating Regulatory Landscapes

Renewable energy regulations continuously evolve, requiring investor awareness of potential policy, incentive, and standard changes. Understanding jurisdiction-specific rules becomes essential for assessing long-term viability. Shifts in government support, tax policies, and environmental regulations can significantly affect investment profitability and value.

Regulatory complexities vary substantially across jurisdictions, demanding thorough comprehension of governing legal frameworks. Engaging legal specialists often proves beneficial for navigating these intricacies.

Valuation and Pricing Models

Determining accurate renewable energy asset valuations involves complex processes. Multiple methodologies exist, including discounted cash flow analysis, comparable company evaluation, and asset-based approaches. Methodology selection depends on asset specifics and comparable data availability.

Liquidity and Marketability

Secondary market liquidity proves crucial for renewable energy investors. The ability to sell assets without substantial price concessions remains essential. Investors should evaluate market depth and active participant presence for specific asset types. Limited buyer availability can significantly affect sale ease and pricing.

Transaction costs, brokerage fees, and completion timelines require careful consideration. Understanding market depth and participant activity remains vital for successful secondary market trading.

Future Outlook and Trends

Emerging Investment Strategies

Renewable energy secondary markets undergo rapid transformation driven by innovative approaches. Investors increasingly pursue opportunities beyond traditional models, focusing on specific assets like solar arrays, wind farms, and storage systems. This specialization expands viable investment boundaries, with specialized funds and private equity actively participating. The combination of long-term value creation and growing clean energy demand will likely reshape market landscapes.

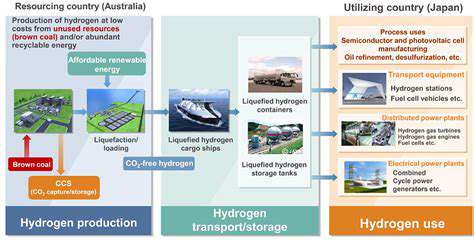

Innovative financial instruments like project-specific bonds and green loans streamline investment processes. These tools provide targeted access to renewable projects, enabling precise portfolio diversification. Understanding unique risk profiles and governing regulations becomes critical for informed decisions. Secondary markets increasingly offer customized solutions aligned with sector evolution.

Technological Advancements and Regulatory Shifts

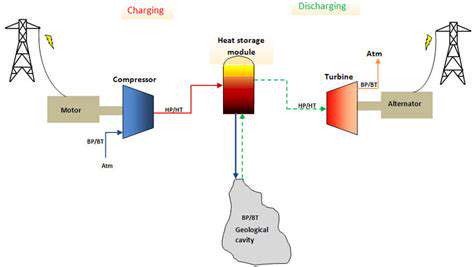

Ongoing renewable technology improvements, including enhanced storage and more efficient solar panels, significantly affect existing asset values and marketability. These advancements often increase energy output and reduce operational costs, boosting investment appeal. This creates positive reinforcement, encouraging further innovation and capital deployment.

Simultaneously, evolving government policies play pivotal roles in shaping secondary market futures. Renewable development incentives, carbon pricing mechanisms, and storage support policies create favorable investment environments. Navigating these regulatory complexities proves essential, particularly for investors unfamiliar with jurisdiction-specific nuances. These factors will continue driving market evolution toward sustainable energy futures.

The interaction between technological progress and regulatory changes will shape future secondary market trends. Investors must monitor these developments to understand implications and capitalize on emerging opportunities.

The dynamic nature of renewable energy secondary markets demands continuous evaluation of technological and regulatory developments. Comprehensive understanding enables effective market participation and supports sustainable energy sector growth.

Investors must recognize potential risks associated with these changes and emphasize rigorous due diligence. As markets grow more sophisticated, careful consideration of project lifespans, maintenance requirements, and evolving regulations becomes increasingly important.