Battery Management Systems (BMS) for Optimal Performance and Safety

Protecting Your Investment: Ensuring Long-Term Battery Health

Ensuring Long-Term Security

Protecting your investment requires a proactive approach to safeguarding your financial assets. Careful planning and diligent monitoring are essential to mitigate potential risks. A well-defined strategy can help you navigate market fluctuations and maintain a stable financial future. This comprehensive approach considers various factors to ensure your investment remains secure and aligned with your long-term goals.

Understanding the nuances of your investment portfolio is crucial. Regular reviews and adjustments are vital to keep your investments on track and provide the best possible return on your capital. A proactive approach to risk management should be a key component of your investment strategy.

Diversification for Stability

Diversifying your investments across various asset classes is a cornerstone of a robust investment portfolio. This strategy helps to spread risk and potentially reduce the impact of market downturns on your overall holdings. By investing in a range of securities, you can potentially achieve more consistent returns over the long term.

Diversification allows you to capitalize on different market trends and reduces the impact of any single investment's performance on your overall portfolio. This approach helps to create a more resilient investment strategy that can weather economic storms.

Thorough Due Diligence

Conducting thorough due diligence on potential investment opportunities is paramount. Researching the financial health and track record of companies or assets is crucial before committing your capital. This process involves evaluating various factors, including financial statements, industry trends, and management expertise.

Understanding the market conditions and the specific risks associated with a particular investment is also a key aspect of due diligence. In-depth research and careful analysis are essential for making informed decisions that align with your financial goals.

Regular Portfolio Reviews

Regularly reviewing your investment portfolio is essential for maintaining alignment with your financial objectives. Monitoring performance, evaluating market conditions, and adjusting your strategy based on these factors are vital for maximizing returns and minimizing risks. This ongoing analysis allows you to adapt to changing market dynamics.

Identifying any potential issues early on and making necessary adjustments can significantly impact the long-term success of your investments. Consistent portfolio reviews enable you to maintain a proactive approach and ensure your investments remain on the optimal path.

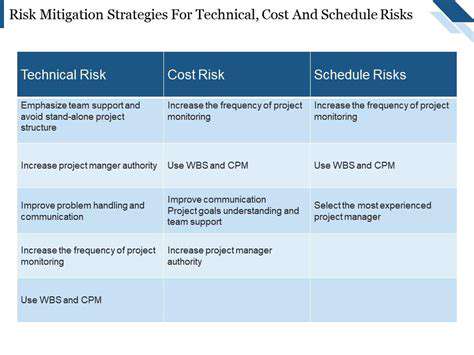

Risk Management Strategies

Developing robust risk management strategies is essential to protect your investment portfolio. Understanding and mitigating potential threats is crucial for preserving capital and achieving your financial goals. This involves identifying and assessing potential risks, such as market volatility, economic downturns, and industry-specific challenges.

Investment Education and Guidance

Staying informed about investment principles and market trends is crucial for making sound decisions. Seeking professional guidance from qualified financial advisors can provide valuable insights and support. Educating yourself on various investment strategies and market dynamics can enhance your decision-making process.

Understanding the potential rewards and risks associated with different investment vehicles is vital for informed choices. Learning about financial markets and economic factors can greatly enhance your investment knowledge and ensure you make informed decisions.

Adaptability and Flexibility

Adapting your investment strategy to changing market conditions is crucial for long-term success. Being flexible and open to adjusting your approach based on market trends and economic developments is essential. This involves evaluating performance metrics, assessing emerging opportunities, and making informed decisions about asset allocation.

Remaining adaptable and flexible allows you to capitalize on opportunities and navigate challenges effectively. This ongoing adaptation ensures that your investment strategy remains aligned with your goals and the evolving economic landscape.