Corporate Renewable Procurement: A Business Imperative

Driving Innovation Through Strategic Compliance

While meeting regulatory standards is essential, businesses that take a forward-thinking approach to compliance often uncover unexpected opportunities. Rather than viewing regulations as constraints, innovative companies integrate them into their strategic planning from day one. This mindset shift transforms compliance from a cost center into a catalyst for breakthroughs that redefine industry standards. The most successful organizations don't just react to policy changes - they anticipate them, creating solutions that often surpass what regulators initially envisioned.

Modern compliance initiatives serve dual purposes: they maintain legal standing while simultaneously driving the creation of novel offerings. Firms adopting this dual-track strategy frequently develop capabilities that give them first-mover advantages in emerging markets. What begins as regulatory adherence often evolves into proprietary systems that competitors struggle to replicate.

Building Trust and Enhancing Reputation

Stakeholder confidence grows exponentially when companies demonstrate authentic commitment to ethical operations. Investors increasingly scrutinize governance practices, while customers favor brands with verifiable sustainability credentials. The correlation between transparent operations and brand equity has never been stronger across all market sectors.

Organizations that institutionalize accountability mechanisms create self-reinforcing cultures of integrity. When employees see leadership consistently making principled decisions, it establishes behavioral norms that permeate every business unit. This cultural foundation often becomes a company's most valuable intangible asset.

Improving Operational Efficiency and Risk Management

Well-designed compliance frameworks naturally eliminate process inefficiencies through standardization. By mapping regulatory requirements to operational workflows, businesses frequently discover redundancies they can streamline. The most sophisticated compliance systems function as early warning networks, identifying potential issues long before they escalate into crises.

This preventative approach to risk creates organizational resilience that weathers market fluctuations. Companies with mature compliance infrastructures typically demonstrate remarkable stability during industry disruptions, often gaining market share when competitors falter.

Attracting and Retaining Top Talent

The modern workforce prioritizes purpose-driven employment, with compliance playing an unexpected role in recruitment. Professionals increasingly seek employers whose values align with their personal ethics. Companies recognized for principled operations consistently report higher employee engagement scores and lower turnover rates across all levels.

Clear compliance guidelines create work environments where employees understand boundaries and expectations. This clarity reduces workplace friction and empowers teams to focus on value creation rather than navigating ethical gray areas.

Enhancing Customer Loyalty and Market Share

Consumer behavior studies reveal growing preference for brands with demonstrable ethical commitments. In an era of increased social consciousness, compliance has become a competitive differentiator rather than just a legal requirement. Businesses that transparently communicate their compliance achievements often develop intensely loyal customer bases willing to pay premium prices.

This brand equity translates directly to market performance, with compliant companies frequently outperforming sector averages. The reputational halo effect of strong governance practices creates sustainable advantages that marketing budgets alone cannot buy.

Unlocking Growth and Sustainability

Long-term corporate viability increasingly depends on integrating compliance with growth strategies. Investors now evaluate governance practices with the same rigor as financial metrics when assessing opportunities. Companies demonstrating ethical maturity typically enjoy easier access to capital and more favorable partnership terms throughout their ecosystems.

This virtuous cycle of trust-building creates organizational resilience that supports multi-generational success. As markets continue evolving, businesses with compliance-embedded cultures maintain remarkable adaptability to changing conditions.

Managing Risks and Building Resilience

Identifying Potential Risks

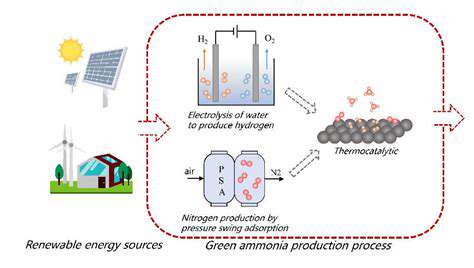

The transition to renewable energy involves navigating complex risk landscapes that differ significantly from traditional procurement. Beyond obvious considerations like weather dependency, smart organizations analyze second-order effects including transmission constraints and technology obsolescence timelines. Comprehensive risk mapping should evaluate each renewable source's unique failure modes across different operational scenarios.

Supplier vetting requires specialized expertise in renewable technologies, moving beyond standard financial checks to assess technical capabilities and maintenance track records. The most thorough due diligence processes incorporate site visits, third-party technical audits, and scenario stress-testing with engineering teams.

Ensuring Supply Chain Security

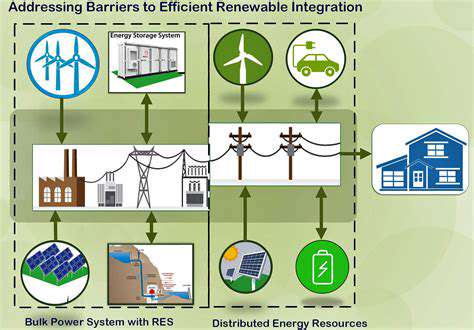

Renewable energy supply chains demand geographic and technological diversification strategies that account for production intermittency. Leading procurement teams establish multi-layered supplier networks with overlapping coverage areas to mitigate regional disruptions. Creative contracting approaches, including capacity reservation agreements and option-based procurement, provide flexibility while ensuring baseline supply.

Navigating Regulatory Hurdles

Regulatory environments for renewables change rapidly across jurisdictions. Sophisticated organizations maintain dedicated policy tracking teams that monitor legislative developments and subsidy program modifications. This intelligence informs dynamic procurement strategies that align with incentive structures while anticipating future policy directions.

Managing Fluctuating Energy Prices

Advanced procurement strategies blend fixed-price contracts with indexed arrangements to balance cost certainty with market opportunity. Some organizations employ algorithmic purchasing tools that optimize buy timing based on weather forecasts, demand patterns, and storage capacity. Structured financial products like swing contracts and virtual PPAs provide additional price risk management tools.

Building Resilience Through Diversification

True energy resilience requires portfolio approaches that combine generation technologies with complementary production profiles. For example, solar-wind hybrids smooth output variability, while strategic battery deployments address intraday imbalances. Geographic dispersion across climate zones further buffers against localized weather impacts.

Evaluating and Monitoring Performance

Effective renewable procurement demands real-time performance tracking against multiple dimensions. Beyond basic generation metrics, best-in-class monitoring evaluates equipment health, predictive maintenance needs, and actual versus modeled performance. Machine learning applications now enable predictive analytics that identify emerging issues weeks before traditional monitoring would detect them.