Corporate Renewable Procurement for Financial Institutions: Leading by Example

Measuring and Reporting on Progress: Transparency and Accountability

Defining Key Performance Indicators (KPIs)

Establishing clear and measurable KPIs is crucial for accurately tracking progress. These indicators must align with the overall corporate goals and strategic objectives, providing a quantifiable benchmark for success. Selecting the right KPIs is not just about picking numbers; it's about choosing metrics that truly reflect the company's performance and progress towards its vision. For example, if a company aims to improve customer satisfaction, KPIs might include customer feedback scores, Net Promoter Scores (NPS), and customer retention rates.

Furthermore, KPIs should be specific, measurable, achievable, relevant, and time-bound (SMART). This ensures that the targets are realistic and that progress can be tracked effectively. A well-defined set of KPIs will provide a clear roadmap for achieving corporate objectives.

Establishing Baseline Data

Before measuring progress, a critical step is establishing a baseline. This involves gathering data on current performance levels across various aspects of the business. Analyzing historical data, reviewing existing reports, and conducting surveys are essential components of this process. Understanding the current state of affairs provides a crucial benchmark against which future progress can be measured and compared.

Baseline data allows for objective evaluation of performance improvements. Without a clear understanding of the starting point, it's difficult to determine if the company is making significant strides or if efforts are falling short of expectations.

Implementing Tracking Mechanisms

Effective tracking mechanisms are essential for monitoring progress and identifying areas for improvement. These mechanisms may include project management software, data analytics tools, or custom reporting dashboards. Choosing the right tools depends on the nature of the data being tracked and the complexity of the reporting requirements.

These tools should be designed to automatically collect and compile data, enabling timely and accurate reporting. This automated process streamlines the reporting process, allowing stakeholders to access up-to-date information on progress towards corporate objectives.

Regular Reporting and Communication

Transparency and communication are key elements in maintaining accountability. Regular reporting, whether weekly, monthly, or quarterly, provides stakeholders with clear insights into the company's progress. This transparency fosters trust and allows for early identification of any potential issues or roadblocks.

The reports should be easily accessible and understandable, presenting data in a clear and concise manner. Effective communication channels, such as email newsletters, internal presentations, or dedicated intranet pages, ensure that the information reaches the relevant stakeholders.

Analyzing Trends and Identifying Areas for Improvement

Analyzing trends in the collected data is crucial for identifying areas where the company is excelling and where improvements are needed. By examining patterns and correlations in the data, businesses can pinpoint opportunities to optimize processes and strategies.

Data analysis should be used to identify bottlenecks, inefficiencies, and potential risks. This analysis is crucial for making informed decisions and adjusting strategies to maximize progress and achieve corporate objectives effectively.

Accountability and Responsibility

Establishing clear lines of accountability is vital for ensuring that individuals and teams are responsible for achieving their targets. This involves assigning ownership to specific individuals or departments for different aspects of the progress measurement process. Clear roles and responsibilities will help ensure that everyone is actively contributing to the overall success of the corporate objectives.

Regular performance reviews and feedback mechanisms are crucial for maintaining accountability and fostering a culture of continuous improvement. This helps identify strengths and weaknesses, allowing individuals to improve their performance and contribute more effectively to the company's overall goals.

The Future of Financial Institutions and Renewable Procurement

The Integration of Sustainability into Core Banking Functions

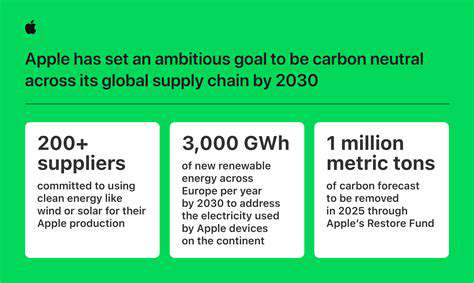

Financial institutions are increasingly recognizing the crucial link between their own profitability and the long-term viability of renewable energy procurement. This understanding is driving a significant shift towards integrating sustainability considerations into core banking functions, impacting everything from loan underwriting to investment strategies. This proactive approach not only mitigates environmental risks but also positions institutions for future growth in a rapidly evolving market.

The integration process encompasses assessing the environmental impact of existing portfolios and proactively seeking opportunities to finance and support renewable energy projects. This involves developing new products and services that cater to the growing demand for sustainable solutions, and potentially even revising existing financial instruments to better incentivize environmentally friendly practices.

Technological Advancements and Data-Driven Decision Making

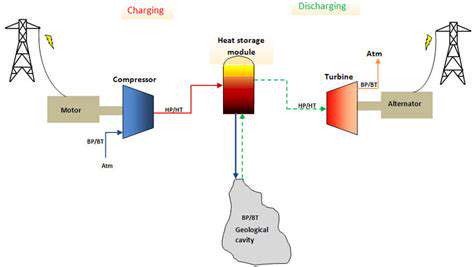

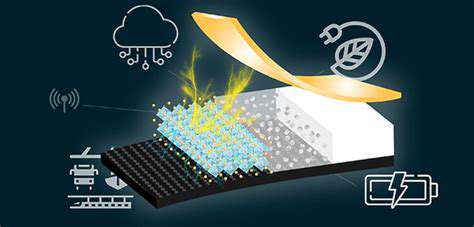

The future of financial institutions and renewable procurement is inextricably linked to technological advancements. Sophisticated data analytics and AI-powered tools are enabling more precise assessments of renewable energy project viability, risk mitigation, and market trends. This data-driven approach allows for more informed investment decisions, optimizing returns while minimizing environmental impact.

Furthermore, blockchain technology offers promising solutions for transparent and secure tracking of renewable energy generation and consumption. This enhanced visibility is critical for building trust and fostering collaboration between stakeholders across the renewable energy value chain. Ultimately, these technological advancements will streamline operations, reduce costs, and improve overall efficiency.

The Rise of Sustainable Finance Products and Services

The demand for green financing solutions is soaring, driving the development of innovative financial products and services designed specifically to support renewable energy initiatives. These offerings include green bonds, sustainability-linked loans, and impact investments, all aimed at attracting capital to the renewable energy sector. Financial institutions that proactively develop and implement these products will gain a competitive edge in the market and contribute significantly to the transition to a sustainable energy future.

The Growing Importance of Stakeholder Engagement and Collaboration

Successfully navigating the future of financial institutions and renewable procurement necessitates robust stakeholder engagement and collaboration. This includes working closely with governments, NGOs, and renewable energy developers to create supportive policies and facilitate project development. Transparency and open communication are crucial to fostering trust and building long-term partnerships, ensuring sustainable growth within the industry.

Furthermore, engaging with customers and investors who prioritize sustainability is paramount. Communicating the value proposition of sustainable investments and the environmental benefits of renewable energy procurement is critical to attracting and retaining clients while demonstrating corporate social responsibility.

Regulatory Landscape and Policy Influences

The evolving regulatory landscape plays a significant role in shaping the future of financial institutions and renewable procurement. Stringent environmental regulations and carbon pricing mechanisms are driving the adoption of cleaner energy sources, prompting financial institutions to adapt their strategies and portfolios accordingly. This presents both challenges and opportunities, necessitating a deep understanding of the regulatory environment and proactive engagement with policy developments.

Financial institutions must stay informed about and adapt to changing regulations to ensure compliance and capitalize on potential opportunities in the growing market for sustainable finance. This includes anticipating future policy shifts and proactively aligning their operations with the evolving legal framework.