Financial Innovation in Renewable Energy

Securitization: A Deep Dive

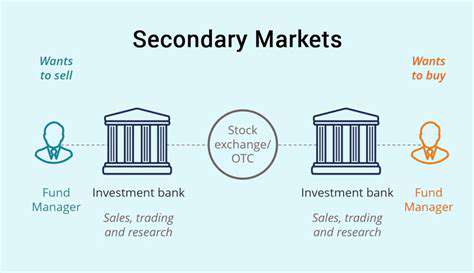

Asset-backed securities transform illiquid holdings into tradeable instruments through meticulous structuring. The process involves segregating assets into distinct risk tranches, allowing investors to select exposure levels matching their risk appetite. Recent innovations include securitizing intellectual property royalties, unlocking value from patents and copyrights that previously lacked liquidity.

Green bond securitization demonstrates environmental applications, where proceeds fund renewable energy projects. Investors receive returns while supporting sustainability goals—a dual benefit driving market growth.

Project Finance: Structuring for Success

Large-scale infrastructure projects increasingly utilize non-recourse financing, where lenders' claims extend only to project assets. This approach protects parent companies from project-specific liabilities while attracting specialized investors. Public-private partnerships (PPPs) leverage this model to deliver essential services without straining government budgets.

Toll road developments exemplify successful project finance, where future revenue streams secure construction funding. Dynamic toll pricing algorithms now optimize traffic flow while ensuring investor returns, showcasing technological integration with financial structuring.

Bridging the Gap: Combining Securitization and Project Finance

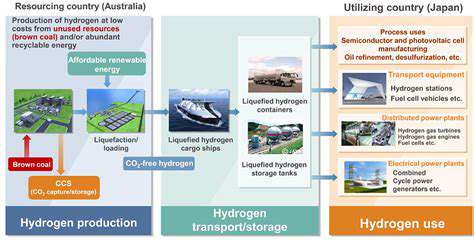

Solar farm developers pioneer hybrid models by issuing asset-backed securities tied to power purchase agreements. This convergence creates secondary markets for clean energy investments, attracting institutional capital to sustainability projects. Offshore wind farms similarly benefit, with turbine output contracts packaged into tradeable green bonds.

Municipalities adopt these techniques for water infrastructure upgrades, demonstrating how innovative financing addresses critical public needs. Investors gain predictable returns from essential services, while communities benefit from modernized systems.

Improving Accessibility to Capital

Mini-bonds open project investing to retail participants, democratizing access to opportunities once reserved for institutions. Online platforms facilitate these offerings with educational resources, helping individuals evaluate risk profiles. Blockchain-based security tokens further lower barriers, enabling global participation in local projects with fractional ownership structures.

Supply chain financing programs illustrate how technology enhances accessibility. Suppliers receive early payment on invoices through investor-funded platforms, improving cash flow while offering investors short-term, secured returns.

Enhancing Risk Management

Catastrophe bonds showcase innovative risk transfer, where insurers access capital markets to cover extreme events. Investors earn high yields unless predefined disasters occur—a model now applied to pandemic coverage. Machine learning transforms collateral management, continuously adjusting requirements based on real-time asset valuations.

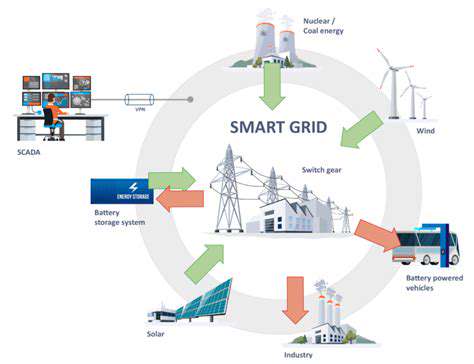

Project finance increasingly incorporates climate resilience metrics, with financing terms linked to sustainability performance. This alignment ensures long-term viability while meeting investor ESG (Environmental, Social, Governance) criteria.

Crowdfunding and Impact Investing: Empowering Collective Action

Harnessing Collective Capital for Social Good

Digital platforms enable grassroots funding of community solar installations, allowing neighbors to collectively own renewable energy systems. This model bypasses traditional utility structures, putting energy democracy within reach. Similarly, microloan crowdfunding connects individual lenders with entrepreneurs in developing economies, fostering economic development at hyperlocal levels.

Donor-advised funds for impact investing demonstrate how philanthropic capital can seed social enterprises. These vehicles allow gradual deployment of funds while earning market-rate returns, maximizing both financial and social impact.

Diversifying Investment Portfolios

Impact-focused ETFs (Exchange-Traded Funds) now offer retail investors exposure to curated baskets of sustainable companies. Thematic funds targeting specific UN Sustainable Development Goals allow precise alignment of investments with personal values. Digital platforms facilitate direct investment in women-led businesses, addressing historical funding disparities while diversifying portfolios.

Convertible notes for social enterprises present hybrid instruments, offering investors equity participation if certain impact metrics are achieved. This structure balances financial returns with mission alignment.

Evaluating Social and Environmental Impact

Third-party impact verification services employ blockchain for tamper-proof reporting. Satellite imagery and IoT sensors provide real-time monitoring of reforestation projects, giving investors concrete evidence of environmental impact. Standardized metrics like IRIS+ (Impact Reporting and Investment Standards) enable apples-to-apples comparisons across impact investments.

Impact-weighted accounting initiatives reshape financial statements, quantifying social and environmental externalities in monetary terms. This transparency helps investors make informed decisions balancing profit and purpose.

Addressing Societal Challenges

Community land trusts utilize crowdfunding to create permanently affordable housing, countering gentrification pressures. Investors receive modest returns while preserving neighborhood character and preventing displacement. Similarly, education crowdfunding platforms fund classroom projects in underserved schools, directly addressing educational inequities.

Disaster recovery crowdfunding demonstrates rapid response capabilities, channeling resources to affected areas within hours. These platforms increasingly integrate with official relief efforts, creating public-private response networks.

Transparency and Accountability

Smart contract-powered escrow systems release funds only when verified milestones are achieved. Decentralized autonomous organizations (DAOs) govern some impact projects, with token-holders voting on fund allocation. This participatory model enhances accountability while reducing administrative overhead.

Blockchain-based provenance tracking ensures impact investors can trace every dollar to its end use. For agricultural projects, this technology verifies fair trade practices from farm to consumer, building trust across supply chains.

Location-aware technologies transform routine commutes into immersive learning experiences. Augmented reality overlays historical images onto modern cityscapes, making urban exploration an educational adventure. Science students conduct field research using smartphone sensors, collecting real-world data that feeds into global research databases.