Renewable Energy and Sustainable Finance: Green Bonds and Loans

Green Bonds: A Sustainable Investment

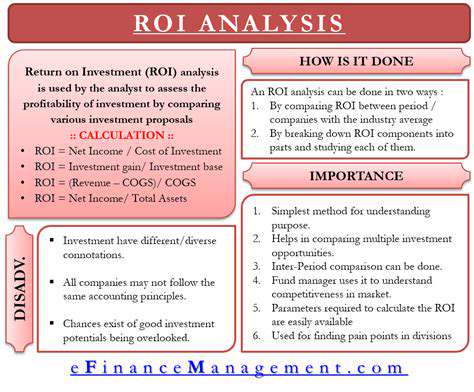

Green bonds are a specialized type of bond that is issued to finance projects and initiatives with environmental benefits. These bonds are attractive to investors seeking to contribute to a sustainable future while potentially earning a return on their investment. Crucially, the proceeds from the sale of green bonds are specifically earmarked for projects that reduce greenhouse gas emissions, promote renewable energy, conserve biodiversity, or improve environmental quality. This dedicated allocation ensures the funds are deployed in a way that aligns with the environmental goals of the bond.

The key differentiator of green bonds lies in their transparency and rigorous environmental and social due diligence. These bonds are typically issued by governments, corporations, and international organizations, and they follow a standardized framework to ensure that the projects they fund meet specific environmental criteria. This commitment to accountability fosters investor trust and confidence in the sustainability of the investments.

Attracting Investment for Renewable Energy Projects

The demand for renewable energy sources is increasing globally, driven by the urgent need to transition away from fossil fuels and mitigate climate change. Green bonds play a critical role in financing this transition by providing a dedicated source of capital for renewable energy projects, such as solar, wind, and hydropower. These projects often require significant upfront investment, and green bonds can help bridge this funding gap, making renewable energy more accessible and affordable.

Green bonds offer an attractive investment opportunity for investors seeking to support environmentally friendly projects. They often come with competitive yields, aligning with the financial goals of investors while contributing to positive environmental outcomes. This attractive combination of financial return and environmental impact makes green bonds an increasingly popular choice for socially conscious investors.

Furthermore, the growing awareness of environmental issues among investors is creating a high demand for sustainable investment options. This demand is further fueled by regulatory frameworks and investor guidelines promoting environmental, social, and governance (ESG) criteria. Green bonds are well-positioned to capitalize on this trend by providing a direct and measurable way for investors to participate in the transition to a sustainable energy future.

The Role of Green Bonds in a Sustainable Future

Green bonds are instrumental in driving the global shift towards a more sustainable future. By channeling investment capital into environmentally friendly projects, they help to accelerate the adoption of renewable energy, enhance energy efficiency, and promote conservation efforts. This, in turn, contributes to a healthier planet and a more resilient economy.

These bonds play a crucial role in mobilizing private capital for environmental projects, supplementing public funding and fostering innovation in sustainable solutions. The transparent nature of green bond issuance and the rigorous due diligence processes ensure that the funds are used effectively and efficiently, maximizing their positive environmental impact. This transparency and accountability are key to building trust among investors and encouraging wider participation in sustainable finance.

Overall, green bonds represent a vital component of a comprehensive strategy to address global environmental challenges. They are a powerful tool for attracting investment, stimulating innovation, and accelerating the transition to a low-carbon economy. Their growing popularity signifies a significant shift in investor priorities and a growing commitment to a more sustainable future.

Green Loans: Supporting Sustainable Business Practices

Understanding Green Loans

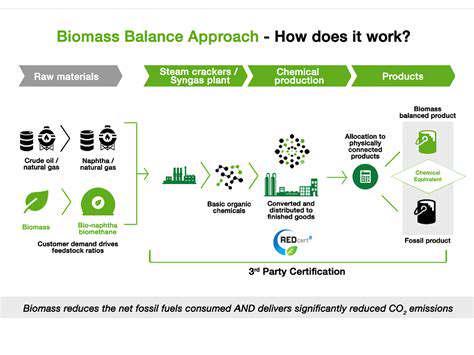

Green loans are financial instruments designed to incentivize environmentally friendly projects and initiatives. These loans are specifically structured to support investments in renewable energy, energy efficiency improvements, sustainable transportation, and other environmentally conscious endeavors. Understanding the specific criteria and eligibility requirements is key to maximizing the potential benefits of these loans.

Essentially, they represent a financial commitment to a greener future, encouraging businesses and individuals to make sustainable choices. These loans can range from small-scale projects to large-scale initiatives, catering to various needs and budgets.

Benefits of Green Loans

The advantages of utilizing green loans are multifaceted. These loans often come with favorable interest rates, reflecting the positive impact of the projects they fund. This can translate to significant cost savings for borrowers over the loan's duration. Reduced environmental impact is another key benefit, leading to a healthier planet for future generations.

Furthermore, green loans can unlock access to capital for businesses or individuals who may not otherwise qualify for traditional funding. They can also enhance the borrower's reputation and attract environmentally conscious investors and partners.

Eligibility Criteria for Green Loans

Eligibility for green loans typically hinges on the project's environmental impact. Specific criteria may include the utilization of renewable energy sources, the implementation of energy-efficient technologies, or the adoption of sustainable practices. Demonstrating a clear environmental benefit is crucial for securing the loan.

Types of Projects Funded by Green Loans

Green loans can support a wide range of projects. These include investments in solar panels, wind turbines, energy-efficient building renovations, and sustainable agricultural practices. The projects often focus on reducing carbon emissions and promoting resource conservation. The range of projects demonstrates the adaptability of green loans to diverse needs.

Government Incentives and Support

Many governments offer incentives and support programs for green loans. These incentives often take the form of tax breaks, grants, or streamlined approval processes. These incentives effectively encourage and streamline the adoption of sustainable practices. Understanding these incentives can significantly impact the feasibility and financial attractiveness of green loan projects.

Environmental Impact of Green Loans

The overarching goal of green loans is to foster a more sustainable future. By funding environmentally responsible projects, they contribute to a reduction in carbon emissions, conservation of resources, and protection of biodiversity. The cumulative impact of numerous green loans can be remarkable in driving widespread environmental improvements.

Sustainable Development and Green Loans

Green loans are a vital tool in achieving sustainable development goals. They support projects that contribute to a healthier environment, economic growth, and social equity. Implementing green loans is essential for creating a more sustainable world. These loans are not just financial instruments; they are catalysts for positive change in the global landscape.

Consumer choices extend far beyond the immediate purchase. The products we buy, the brands we support, and the companies we patronize all contribute to a larger societal impact. This extends to environmental sustainability, labor practices, and ethical sourcing. Understanding this ripple effect is crucial to appreciating the power of collective action, where individual consumer decisions, when combined, can create significant change.

Challenges and Opportunities in the Sustainable Finance Landscape

Navigating Regulatory Hurdles

The renewable energy sector faces a complex web of regulations, often varying significantly between jurisdictions. This necessitates a deep understanding of local and international policies, standards, and permitting processes. Navigating these complexities can be a significant hurdle for investors and developers, requiring substantial resources and expertise. Successfully navigating these regulatory landscapes is crucial for project viability and long-term sustainability.

Furthermore, the evolving nature of environmental regulations, including those related to emissions reduction targets and carbon pricing mechanisms, creates ongoing uncertainty. Companies need to adapt their strategies and operations to stay ahead of these regulatory changes, which can be challenging and costly to implement.

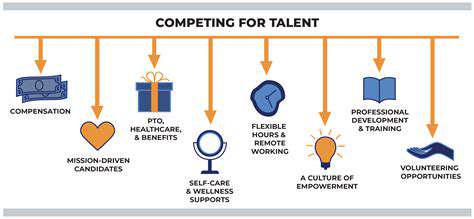

Attracting and Retaining Skilled Workforce

The sustainable finance sector, particularly in renewable energy, relies heavily on a skilled workforce possessing expertise in areas like project development, engineering, finance, and policy. However, a shortage of qualified professionals often hinders the sector's growth and expansion. Attracting and retaining this talent becomes increasingly crucial as the demand for renewable energy solutions rises.

Companies must invest in training and development programs to upskill existing employees and attract new talent. Attractive compensation packages, fostering a positive work environment, and promoting career progression are crucial for retaining skilled professionals in the face of competition.

Securing Long-Term Funding

Project financing for large-scale renewable energy initiatives often requires substantial capital investments, creating a need for innovative funding mechanisms. Traditional financing models may not always be sufficient to meet the scale and complexity of these projects. Finding reliable and sustainable sources of capital, particularly long-term financing, is a major challenge.

Exploring innovative financial instruments, such as green bonds and project finance structures, is essential. Establishing transparent and trustworthy investment platforms that cater to long-term investors is critical for attracting sufficient funding to support the expansion of renewable energy projects.

Addressing Intermittency and Grid Integration

Renewable energy sources, such as solar and wind power, are inherently intermittent. This poses challenges in ensuring a stable and reliable energy supply. Integrating these intermittent sources into existing power grids requires sophisticated grid management systems and potentially new infrastructure investments.

Developing advanced energy storage technologies and implementing smart grid solutions are crucial to address the intermittency issue. These solutions are essential for ensuring the reliable and efficient integration of renewable energy into the broader energy system. Investing in these technologies and infrastructure improvements is paramount for the success of the renewable energy transition.

Minimizing Environmental Impact and Social Equity

While renewable energy is crucial for a sustainable future, the entire lifecycle of these projects must be considered. This includes potential impacts on land use, biodiversity, and local communities. Minimizing environmental damage and ensuring social equity during project development, construction, and operation is essential for long-term sustainability and public acceptance.

Careful environmental impact assessments, community engagement strategies, and equitable benefit-sharing mechanisms are necessary to ensure that renewable energy projects are developed responsibly and contribute positively to local communities. Addressing these concerns is essential for building public support and achieving widespread adoption of renewable energy.