The Economics of Energy Storage: Cost Benefit Analysis

Introduction to Energy Storage Costs

Understanding the Components of Energy Storage Costs

Energy storage costs are multifaceted, encompassing a range of factors that significantly impact the overall financial viability of implementing these systems. These costs extend beyond the initial purchase price and include installation, maintenance, and operational expenses. Understanding the breakdown of these components is crucial for accurate cost-benefit analysis and informed decision-making in the realm of energy storage. From procuring the necessary hardware to ensuring ongoing maintenance, a thorough understanding of these various cost elements is essential to assessing the long-term financial implications of energy storage investments.

A key component often overlooked is the lifecycle cost. This involves not only the initial capital expenditure but also the ongoing costs associated with maintenance, repairs, and potential replacements over the lifetime of the energy storage system. These recurring expenses can significantly impact the overall return on investment (ROI) and should be factored into any comprehensive cost analysis. Predicting and budgeting for these future costs is essential for projecting long-term financial performance.

Furthermore, the specific technology used for energy storage plays a pivotal role in determining the cost structure. Different technologies, such as batteries, pumped hydro, or compressed air energy storage, possess unique manufacturing processes, installation requirements, and operational characteristics that influence the associated costs. This means that choosing the right technology for a particular application is not just about the initial cost but also the long-term implications for maintenance and replacement.

Factors Influencing Energy Storage Cost Variability

Several factors influence the variability in energy storage costs, making it challenging to provide a single, definitive figure. Geographical location, for instance, significantly impacts the price of raw materials and labor, leading to variations in manufacturing and installation costs across different regions. Government policies and incentives also play a substantial role, offering financial support that can reduce the overall cost of energy storage systems for consumers and businesses.

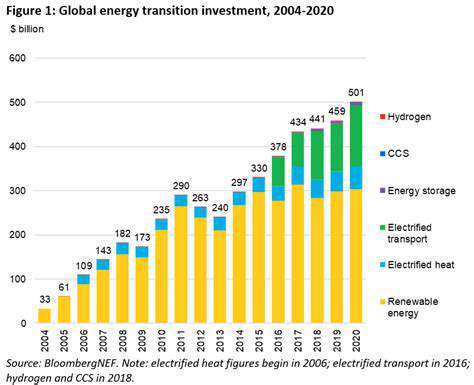

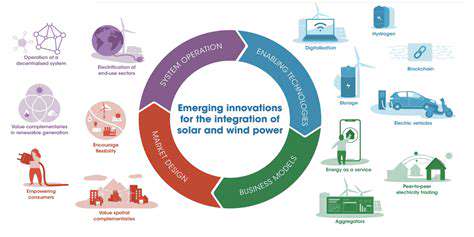

Technological advancements and economies of scale are critical drivers in reducing energy storage costs. As the technology matures and production volumes increase, the cost per kilowatt-hour (kWh) of storage capacity tends to decrease, making energy storage more accessible and affordable. This ongoing development of more efficient and cost-effective storage technologies is essential for the widespread adoption of renewable energy sources and the transition toward a sustainable energy future.

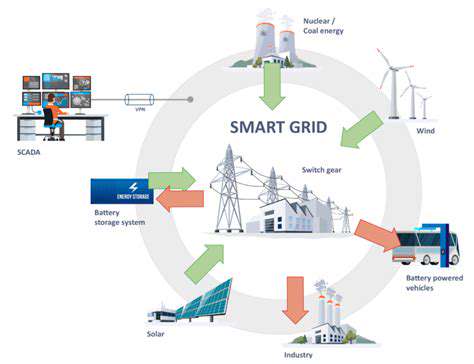

Regulatory frameworks surrounding energy storage and grid integration also contribute to cost variability. Different jurisdictions have varying regulations regarding permitting, interconnection requirements, and grid access. These regulations can increase or decrease project costs, making a thorough understanding of the local regulatory landscape critical for cost planning and project feasibility.

Examining the Cost Structure of Various Storage Technologies

Understanding Variable Costs

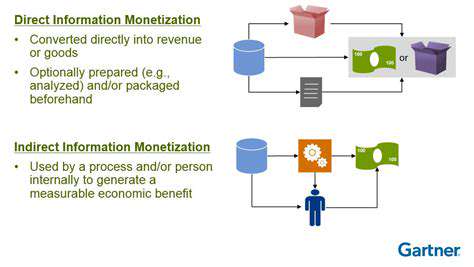

Variable costs, in the context of a Value-Added Investment (VAI), directly correlate with the volume of production or services rendered. These costs fluctuate in direct proportion to output. For example, raw materials required for manufacturing a product, or the direct labor hours needed to assemble it, are prime examples of variable costs. Understanding the variable cost structure is crucial for accurate pricing strategies and for assessing the profitability of different production levels.

Analyzing variable costs is essential for short-term forecasting and decision-making. A detailed breakdown of these costs allows companies to project their expenses based on expected output and make informed decisions about production volumes and pricing strategies. This analysis is particularly useful when evaluating the profitability of different production levels and the impact of changes in raw material prices or labor rates.

Exploring Fixed Costs

Fixed costs, in contrast to variable costs, remain relatively constant regardless of production volume. These costs are incurred even if no output is produced. Examples of fixed costs in a VAI context include rent for office space, insurance premiums, and salaries of administrative staff. Understanding these fixed costs is crucial for long-term financial planning and for ensuring the business can sustain operations even during periods of low output.

Fixed costs play a significant role in determining the break-even point for a VAI. A thorough understanding of these costs is essential for setting appropriate pricing strategies that cover not only variable costs but also fixed costs to achieve profitability. Knowing the fixed cost structure allows managers to make informed decisions about pricing, production levels, and resource allocation to maximize returns.

Another important aspect of fixed costs is their impact on profitability. The higher the fixed costs, the higher the break-even point, meaning more units need to be sold to achieve profitability. Therefore, careful consideration of the fixed cost structure is crucial for long-term viability.

Evaluating Semi-Variable Costs

Semi-variable costs represent a blend of fixed and variable components. These costs exhibit elements that remain constant over a specific production range and elements that increase proportionally with output. An example of a semi-variable cost in a VAI scenario might be utilities. A certain amount of utility expenses remains constant, representing a fixed cost, while the usage of electricity or water increases with production, acting as a variable component.

Recognizing the semi-variable nature of certain costs is critical for accurate financial modeling. Failure to account for the variable aspect of these costs could lead to inaccurate projections and potentially affect decision-making related to pricing and production. A thorough analysis, separating fixed and variable components is crucial for precise cost estimations and sound financial management.

Effective management of semi-variable costs is essential for optimizing profitability. By understanding the cost structure, businesses can identify opportunities to reduce both fixed and variable components, ultimately improving their overall financial performance.

Future Outlook and Challenges in Energy Storage Economics

Technological Advancements and Opportunities

The future of the electronic industry is brimming with exciting possibilities driven by rapid technological advancements. Innovations in materials science are leading to lighter, more durable, and more energy-efficient electronic devices. This translates into a wide range of potential applications, from portable electronics that can last longer on a single charge to more powerful and compact computing systems. The development of new semiconductor materials promises to enhance processing speeds and reduce energy consumption, paving the way for more sustainable and powerful electronic products.

Furthermore, advancements in artificial intelligence and machine learning are poised to revolutionize how we interact with electronics. Smart devices will become even more intuitive and responsive, anticipating our needs and enabling seamless integration into our daily lives. This integration will not only improve convenience but also unlock new possibilities for personalized experiences and tailored solutions across various sectors.

Market Trends and Consumer Demand

The electronic market is constantly evolving, shaped by changing consumer preferences and emerging trends. Consumers are increasingly demanding more sustainable and environmentally friendly products, which is driving manufacturers to adopt eco-conscious manufacturing processes and materials. This growing awareness of environmental impact is likely to become a significant factor in purchasing decisions, forcing companies to prioritize sustainability in their operations.

Another significant trend is the rise of personalized electronics. Consumers are seeking devices and experiences tailored to their individual needs and preferences. This trend emphasizes customization, enabling users to personalize their electronic devices and integrate them seamlessly with their lifestyle. These personalized experiences are expected to shape the future of the electronic market and drive innovation in product design and functionality.

The demand for connectivity and seamless integration between different devices is also accelerating. Consumers want a unified experience across their various electronic devices, and manufacturers are responding by creating interconnected ecosystems. This trend is driving the development of advanced technologies like 5G and other high-speed communication networks, further enhancing the user experience.

Overcoming Obstacles and Ensuring Sustainability

Despite the exciting prospects, several challenges lie ahead. The increasing complexity of electronic devices necessitates sophisticated manufacturing processes and skilled labor, which can pose logistical and economic hurdles. Successfully navigating these challenges will require a robust and adaptable supply chain. Furthermore, the growing demand for rare earth minerals, crucial components in many electronic devices, raises concerns about resource depletion and ethical sourcing practices.

Another key concern is the environmental impact of electronic waste (e-waste). The rapid obsolescence of electronic devices, combined with the increasing number of devices in circulation, creates a significant environmental challenge. Developing sustainable recycling and disposal methods is essential for mitigating the environmental consequences of e-waste and promoting responsible consumption and disposal practices. This necessitates a collective effort from manufacturers, consumers, and governments to ensure a more environmentally sound electronic future.