Sovereign Wealth Funds and Their Growing Role in Renewable Energy

Diversification Strategies

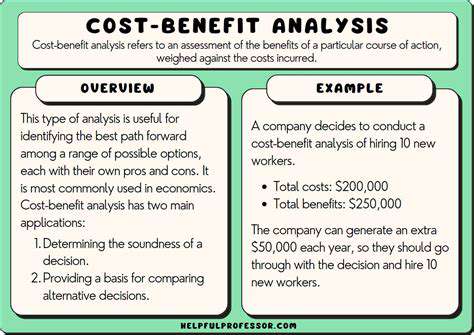

Diversification is a crucial risk management technique that involves spreading investments across various asset classes, industries, and geographies. This strategy aims to reduce the overall portfolio volatility by minimizing the impact of poor performance in one area on the entire investment. By allocating capital to diverse holdings, investors can potentially achieve higher returns while mitigating the risk of significant losses tied to a single investment.

A well-diversified portfolio typically includes a mix of stocks, bonds, real estate, and possibly alternative investments like commodities or private equity. This approach recognizes that different asset classes tend to perform differently under various market conditions. The key is to understand the characteristics of each asset class and how they correlate with each other.

Identifying Risk Factors

Before implementing any diversification strategy, it's essential to identify the specific risk factors that are relevant to your investment goals and circumstances. Understanding these risks is paramount to developing an effective risk mitigation plan. Risk factors can range from market fluctuations to specific industry-related challenges, economic downturns, and even geopolitical events.

Thorough research and analysis are vital to identify potential risks and vulnerabilities. This involves examining historical data, economic forecasts, and industry trends to gain a comprehensive understanding of the possible challenges that could impact your investments.

Asset Allocation Models

Various asset allocation models provide frameworks for diversifying investments. These models help determine the optimal mix of different asset classes based on factors like risk tolerance, investment horizon, and financial goals. Understanding these models allows investors to make informed decisions about their portfolio composition.

Different models, like the Modern Portfolio Theory (MPT) or the Capital Asset Pricing Model (CAPM), offer unique perspectives on optimizing portfolio diversification. These models can help investors construct portfolios that align with their specific needs and risk profiles.

Importance of Correlation Analysis

Analyzing the correlation between different assets is crucial for effective diversification. Understanding how assets move in relation to each other helps in identifying opportunities to reduce overall portfolio risk. A low correlation between assets means that they are less likely to move in tandem, leading to a more stable portfolio.

Risk Tolerance and Investment Horizon

Risk tolerance and investment horizon play a significant role in determining the appropriate diversification strategy. Someone with a high risk tolerance and a long investment horizon might opt for a more aggressive portfolio with a higher allocation to stocks. Conversely, a lower risk tolerance and a shorter investment horizon might necessitate a more conservative approach with a greater emphasis on bonds.

Considering your individual circumstances is essential to tailor a diversification strategy that aligns with your personal financial goals and risk tolerance. These are critical factors in building a portfolio that meets your needs.

Implementing Diversification Strategies

Implementing a sound diversification strategy necessitates consistent monitoring and adjustments over time. Market conditions and economic factors can change, requiring portfolio adjustments to maintain the desired level of risk mitigation. Regular reviews and rebalancing are essential to ensure the portfolio remains aligned with the investor's goals.

It's important to understand that diversification is not a one-time event; it's an ongoing process that requires vigilance and adaptation to changing market conditions. Active management and adjustments are vital to maintaining a well-diversified portfolio.

Beyond Asset Allocation

Diversification extends beyond just asset allocation. It also encompasses factors like geographical diversification, industry diversification, and even company diversification. These approaches aim to reduce the concentration of risk within specific sectors or regions.

By strategically distributing investments across different regions and industries, investors can further reduce the impact of unforeseen events or economic downturns in a particular location or sector. This ensures a more stable and resilient portfolio overall.

Strategic Partnerships and Technological Advancements: Catalyzing Innovation

Strengthening Global Collaboration

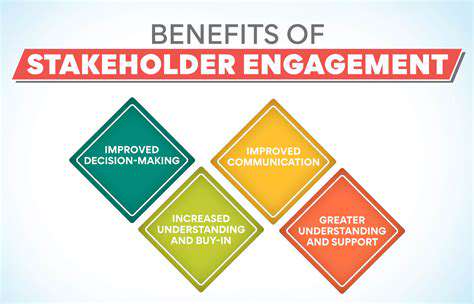

Strategic partnerships play a crucial role in fostering innovation and driving progress in the realm of sovereign technology. By joining forces with international organizations, research institutions, and private sector entities, nations can leverage diverse expertise and resources to accelerate the development and deployment of cutting-edge solutions. This collaborative approach enables the sharing of knowledge, best practices, and technological advancements, leading to more robust and resilient sovereign capabilities across various sectors, from defense and security to critical infrastructure.

These partnerships are essential for tackling complex challenges that transcend national borders. For example, in the field of cybersecurity, international collaboration can lead to the development of shared threat intelligence platforms and the creation of robust, interoperable security protocols. This collaborative approach is critical for protecting national assets in an increasingly interconnected world.

Leveraging Emerging Technologies

The rapid advancement of technologies like artificial intelligence, quantum computing, and biotechnology presents unprecedented opportunities for innovation in sovereign domains. Embracing these advancements is crucial for maintaining a competitive edge and securing a nation's future. AI, for instance, can be leveraged to enhance decision-making processes in areas such as national security, resource management, and economic forecasting.

Quantum computing holds the potential to revolutionize various sectors, including cryptography, materials science, and drug discovery, thereby bolstering a nation's scientific and technological prowess. Furthermore, advancements in biotechnology can lead to breakthroughs in healthcare, agriculture, and environmental protection, contributing significantly to national well-being and security.

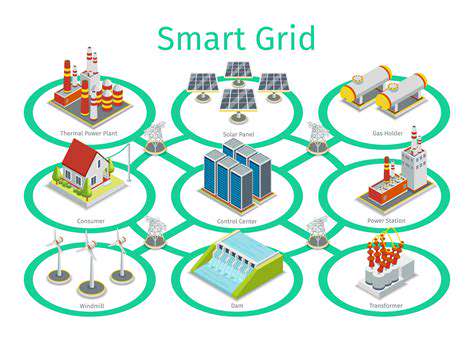

Developing Secure and Resilient Infrastructure

Modernizing and securing critical infrastructure is paramount for ensuring national resilience and stability. This involves implementing robust cybersecurity measures, fostering digital literacy, and investing in advanced infrastructure technologies. For example, the development of secure and resilient communication networks is vital for maintaining secure command and control capabilities, enabling efficient coordination during emergencies, and facilitating the seamless exchange of information between various stakeholders.

Ensuring the integrity and availability of critical infrastructure against cyberattacks and other threats is essential. This includes investing in advanced detection and response systems, implementing robust security protocols, and promoting collaboration between public and private sectors to enhance overall resilience. This proactive approach not only mitigates risks but also fosters innovation in infrastructure development and maintenance.

Promoting Domestic Innovation Ecosystems

Cultivating a vibrant domestic innovation ecosystem is essential for fostering technological advancement and ensuring national competitiveness. This involves supporting research and development activities, promoting entrepreneurship, and creating an environment conducive to the growth of innovative startups and ventures. Encouraging collaboration between academia, industry, and government can accelerate the translation of research findings into practical applications, leading to the development of cutting-edge technologies that address national needs.

Investment in education and training programs is crucial for developing a skilled workforce capable of driving innovation. This includes providing opportunities for continuous learning and upskilling, promoting STEM education, and attracting and retaining top talent in the relevant fields. A robust and adaptable workforce is vital for effectively harnessing technological advancements and ensuring the long-term success of the nation's technological agenda.

Investment Strategies Tailored to National Needs and Global Trends

Investment Strategies for Developed Nations

Developed nations, often characterized by mature economies and established financial systems, face unique investment challenges. Strategies must consider factors like aging populations, declining birth rates, and the need for long-term, sustainable growth. Diversification across asset classes, including equities, bonds, and real estate, is crucial. Careful consideration of inflationary pressures and interest rate environments is also paramount. Investing in sectors supporting innovation and technological advancement is often highly beneficial, as these drive future economic growth and productivity gains.

Furthermore, developed nations often need to balance the desire for returns with the need to maintain social safety nets and infrastructure. This requires careful portfolio management that considers both financial and societal implications. Investment strategies must be underpinned by thorough due diligence and a strong understanding of the unique risk profiles of different sectors and markets within the nation.

Investment Strategies for Emerging Markets

Emerging markets present a dynamic and often high-growth opportunity, but they also come with significant risk. Investment strategies must be tailored to the specific economic conditions, political landscapes, and regulatory environments of individual nations. Strategies often involve a mix of domestic equities and debt instruments, but also include careful consideration of foreign direct investment (FDI) opportunities. Risk mitigation is paramount, and diversification across different industries and sectors is essential to manage volatility.

Understanding the potential for corruption, political instability, and currency fluctuations is critical. Strong due diligence on potential investments, including thorough research and analysis of local market conditions, is necessary to identify and mitigate these risks. Strategies should factor in the potential for higher-than-average returns but also acknowledge the possibility of significant losses.

Adapting to Global Trends in Sovereign Wealth

The global landscape is constantly evolving, and sovereign wealth funds (SWFs) need to adapt their investment strategies to meet these challenges. Technological advancements, climate change, and geopolitical shifts all impact investment opportunities and risk profiles. Understanding these trends is essential to maintaining a strong and diversified portfolio. This includes proactive engagement with emerging technologies and sectors, as well as the development of sustainable investment strategies that address environmental concerns.

Global trends demand a forward-thinking approach. Investment strategies need to anticipate future disruptions and adapt to rapidly changing market conditions. This means actively monitoring macroeconomic indicators, geopolitical events, and technological advancements. SWFs must strive for a balance between short-term gains and long-term strategic goals, while remaining nimble and flexible enough to adjust to unforeseen circumstances.

Sustainable and Ethical Investment Practices

Increasingly, investors are seeking investment opportunities that align with their values, including environmental, social, and governance (ESG) factors. Sovereign wealth funds are recognizing the importance of integrating ESG considerations into their investment strategies. This includes evaluating companies' environmental impact, labor practices, and corporate governance structures. Integrating ESG factors can lead to long-term value creation while minimizing negative societal and environmental consequences.

Sustainable and ethical investment practices are not just a trend, but a critical component of responsible investing. By incorporating ESG criteria, SWFs can build portfolios that contribute to a more sustainable and equitable future. This approach can also enhance long-term financial performance and risk management by identifying and mitigating potential risks associated with unsustainable or unethical practices.