The Business Case for Corporate Renewable Energy: Financial and ESG Benefits

Energy Price Volatility Mitigation: A Critical Financial Consideration

Understanding the Impact of Volatility

Energy price volatility represents one of the most unpredictable financial challenges facing modern enterprises. Unlike fixed operational costs, energy expenses can swing wildly based on geopolitical events, supply chain disruptions, or even seasonal demand shifts. For manufacturers running 24/7 operations, a sudden 20% spike in electricity costs could erase an entire quarter's profit margins. This instability forces CFOs to maintain larger cash reserves than they'd prefer, tying up capital that could otherwise fuel growth initiatives.

The transportation sector provides a stark example - when diesel prices surged during the 2022 energy crisis, some logistics companies saw fuel expenses jump from 30% to nearly 50% of operating costs. These aren't abstract numbers; they translate directly to either painful price hikes for consumers or unsustainable margin compression. Forward-thinking organizations now treat energy cost management with the same rigor as interest rate hedging or foreign exchange risk mitigation.

Strategies for Mitigating Energy Price Volatility

Smart companies employ a layered defense against energy market turbulence. Fixed-price contracts, while sometimes more expensive upfront, provide budget certainty that financial planners cherish. More sophisticated operations use option strategies - paying premiums for the right (but not obligation) to buy energy at predetermined prices. This approach works particularly well for businesses with flexible production schedules that can ramp up during periods of favorable pricing.

Energy efficiency upgrades often deliver the most reliable returns. A Midwest packaging plant recently slashed its natural gas consumption by 38% through heat recovery systems and smart controls - investments that paid for themselves in under two years. When evaluating these projects, the smartest CFOs calculate returns using both current prices and stress-tested scenarios accounting for potential future spikes.

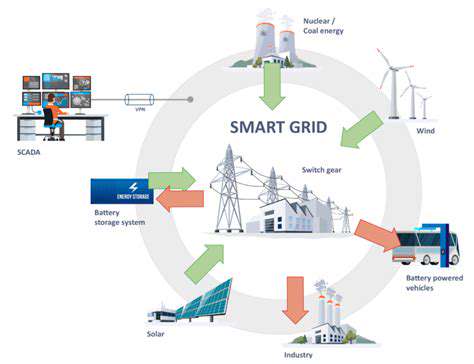

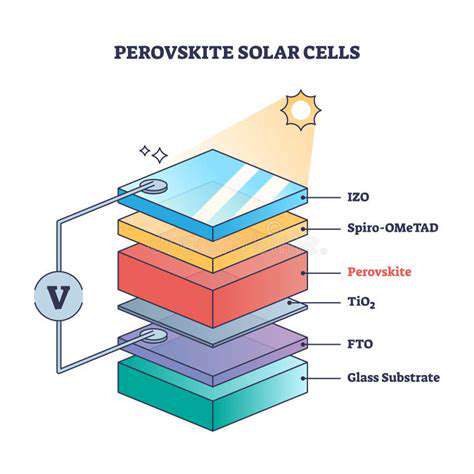

The most transformative solution lies in onsite generation. A Texas data center operator now meets 60% of its power needs through solar+storage, insulating itself from both price swings and grid reliability issues. While the upfront capital gives pause to some boards, the 12-year payback period looks increasingly attractive compared to the alternative of unpredictable energy bills for decades.

ESG Integration: Brand Enhancement and Competitive Advantage

ESG Integration: A Catalyst for Brand Enhancement

Today's consumers wield their wallets as voting tools for the world they want. A 2023 Nielsen study revealed 66% of global respondents will pay premium prices for sustainable goods - a figure that jumps to 75% among millennials. Patagonia's Don't Buy This Jacket campaign paradoxically drove record sales by aligning with customer values around responsible consumption. This isn't about greenwashing; it's about fundamentally rethinking how products are designed, sourced, and brought to market.

The investment community mirrors this shift. BlackRock now screens all investments through an ESG lens, while State Street introduced the Fearless Girl statue specifically to push for more gender-diverse boards. These aren't symbolic gestures - they reflect hard data showing diverse, sustainable companies deliver 2.6% higher annual returns according to MSCI research.

Building Brand Trust Through Transparency

Modern stakeholders demand radical transparency. When outdoor apparel company Cotopaxi publishes its factory audit reports - warts and all - it builds credibility that polished sustainability reports often lack. The most effective disclosures follow the bad news first principle, acknowledging shortcomings before highlighting progress. This authenticity resonates far more than glossy brochures full of stock sustainability imagery.

Attracting and Retaining Talent

The war for talent has entered a new phase. LinkedIn data shows job postings mentioning sustainability grow 8% faster in application rates. At Unilever, employees in sustainability-focused roles demonstrate 30% lower turnover rates - a powerful retention metric in today's competitive labor market. Purpose has become the new workplace currency, with ESG commitments serving as its clearest expression.

Competitive Advantage in a Changing Landscape

Consider Tesla's valuation premium - trading at automotive industry multiples despite producing far fewer vehicles than legacy automakers. This ESG alpha reflects investor confidence in companies positioned for the low-carbon transition, regardless of current financials. Similarly, IKEA's investments in circular design principles now give it first-mover advantage as regulators worldwide enact extended producer responsibility laws.

Operational Efficiency and Reduced Risk: A Holistic Perspective

Improving Operational Processes for Enhanced Efficiency

Lean methodology has evolved beyond manufacturing floors. Hospital networks now apply these principles to patient flow, reducing average discharge times by 22%. The key insight? Waste exists in knowledge work just as much as in physical production - it's just harder to see. Digital twin technology takes this further, allowing companies to simulate process changes before implementation.

Risk Mitigation Strategies for Enhanced Security

Cybersecurity now represents the top operational risk in most boardrooms. The smartest approach layers technical controls (like zero-trust architecture) with human factors - one financial firm reduced phishing success rates by 80% through monthly simulated attacks and mandatory remedial training. This combination of tech and culture change delivers far better protection than either approach alone.

Technological Advancements for Operational Efficiency

Predictive maintenance exemplifies technology's transformative potential. By analyzing vibration patterns from industrial equipment, AI can forecast failures weeks in advance. One European steelmaker achieved a 40% reduction in unplanned downtime using these systems - translating to millions in avoided losses annually. The most advanced implementations now incorporate weather data and supply chain variables for truly holistic operational intelligence.

Financial Implications of Operational Efficiency

Walmart's supply chain optimization delivers a masterclass in operational finance. By cross-docking 85% of inventory (moving goods directly from inbound to outbound trucks), they maintain industry-leading inventory turnover while minimizing warehousing costs. This operational excellence directly enables their everyday low prices strategy - proving efficiency can be a competitive weapon.