The Role of Multilateral Development Banks in Renewable Energy Finance

Global Investment Trends

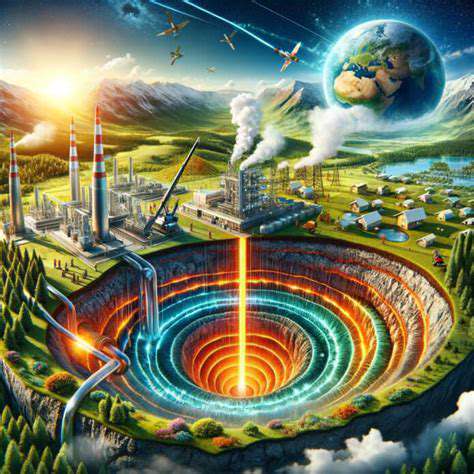

The global landscape of renewable energy finance is experiencing a period of significant growth, driven by escalating concerns about climate change and a burgeoning demand for sustainable energy solutions. This growth isn't uniform across all regions, however, with some nations showing a more pronounced commitment to renewable energy infrastructure development than others, highlighting the need for targeted strategies and international collaboration to accelerate the transition.

International organizations and governments are working to create a more favorable investment environment, including streamlined permitting processes, supportive policy frameworks, and the establishment of dedicated funds to support renewable energy projects. These initiatives are crucial to unlocking the full potential of renewable energy and fostering greater investor confidence in the long-term viability of these investments.

The Role of Multilateral Development Banks

Multilateral development banks (MDBs) play a pivotal role in facilitating the transition to a sustainable energy future. They can leverage their substantial financial resources and technical expertise to support the development and deployment of renewable energy projects, particularly in developing countries where the need for infrastructure improvements is often most pressing. Their role extends beyond capital provision, encompassing advisory services and knowledge sharing, which are crucial for the successful implementation of these projects.

Addressing Financial Barriers

Despite the growing momentum, significant financial barriers remain to be overcome. The upfront capital costs associated with renewable energy projects can be substantial, and securing long-term financing at competitive rates can be challenging. Furthermore, the need for robust regulatory frameworks, transparent procurement processes, and effective risk management strategies to mitigate project financing uncertainties is paramount.

Innovative Financing Mechanisms

Innovation in financing mechanisms is crucial for scaling up renewable energy finance. Exploring new approaches, such as green bonds, impact investments, and blended finance models, can attract a wider range of investors and provide access to capital for a broader range of projects. These innovative mechanisms can also address the specific financing needs of developing countries, fostering a more inclusive and equitable transition to renewable energy.

Policy Support and Regulatory Frameworks

Clear and consistent policy support, including feed-in tariffs, renewable portfolio standards, and tax incentives, is essential to create a stable and predictable investment environment for renewable energy. Robust regulatory frameworks, transparent procurement processes, and effective project risk management strategies are equally crucial for investor confidence and project success. These policies need to be tailored to local contexts and challenges to ensure their effectiveness.

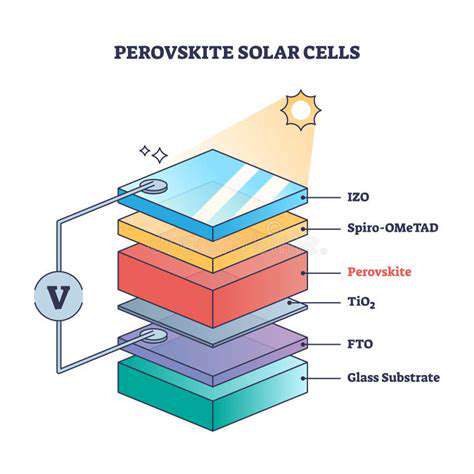

Technology Advancements and Cost Reductions

Rapid technological advancements in renewable energy technologies, coupled with economies of scale, have significantly reduced the cost of renewable energy generation. This has made renewable energy projects increasingly competitive with traditional fossil fuel-based power sources, further fueling the growth of the sector. Continued advancements in technology and innovative solutions will be key to making renewable energy even more cost-effective and accessible in the coming years.

International Cooperation and Knowledge Sharing

International cooperation and knowledge sharing are essential for scaling up renewable energy finance effectively. Sharing best practices, exchanging technical expertise, and fostering collaborations between developed and developing countries can accelerate the deployment of renewable energy projects globally. This collaborative approach is crucial for addressing the global challenge of climate change and ensuring a sustainable energy future for all.