Shifting Capital from Fossil Fuels to Renewable Energy Assets

Identifying and Assessing Fossil Fuel Investments

Identifying Fossil Features

Fossil identification is a crucial step in understanding the history of life on Earth. Careful observation of the preserved remains, or traces of organisms, is essential. This includes examining the shape, size, and any distinctive features. Identifying the type of organism and its potential evolutionary relationships relies on comparing the fossil with known specimens and established geological records. Careful documentation of the context in which the fossil is found, such as the surrounding rock layers and the site's geological history, is also vital. These details often provide critical clues about the fossil's age and environment.

Different types of fossils offer varying degrees of information. For example, fossilized bones and shells can reveal anatomical details. Trace fossils, like footprints or burrows, can provide insights into an organism's behavior and lifestyle. Understanding the specific features of each fossil type is essential for accurate interpretation and contributes significantly to reconstructing past ecosystems.

Assessing Fossil Preservation

The quality of fossil preservation varies greatly depending on numerous factors, including the organism's composition, the depositional environment, and the subsequent geological processes. The degree of preservation can significantly impact the ability to extract information from the fossil. Well-preserved fossils allow for a more detailed understanding of the organism's anatomy and morphology.

Assessing the degree of fossilization is crucial. Some fossils might be mineralized, with original organic material replaced by minerals. Others might show only impressions or casts. Recognizing the specific type of preservation is vital for interpreting the fossil correctly. Evaluating the completeness and condition of the fossil is also important for determining its potential value for scientific research.

Dating Fossil Materials

Dating fossil materials provides crucial information about the age of the fossil and its place within the evolutionary timeline. Radiometric dating techniques, such as carbon-14 dating for younger fossils and uranium-lead dating for older ones, are frequently used. These methods rely on the known decay rates of radioactive isotopes within the fossil or the surrounding rock. Understanding the principles behind these dating methods is essential for interpreting the resulting age estimates accurately.

Analyzing Fossil Environments

Examining the environment in which a fossil was formed offers insights into the past. Fossils are often found in sedimentary rock layers, which can provide clues about the ancient environment. Analyzing the type of sediment, the presence of other fossils, and the overall geological setting can reveal information about temperature, water depth, and other environmental conditions.

Interpreting Evolutionary Relationships

Comparing fossils across different time periods and locations allows scientists to understand evolutionary relationships. This comparison helps to piece together the evolutionary history of life. Analyzing anatomical similarities and differences between fossils, along with geological context, can lead to the identification of evolutionary lineages and patterns of change. This understanding of evolutionary processes is fundamental to our understanding of the diversity of life on Earth.

Applying Fossil Data to Understanding Past Life

Integrating fossil data with other scientific disciplines, such as paleoclimatology and paleoecology, leads to a comprehensive understanding of past life. Reconstructing past ecosystems, assessing past climates, and understanding the evolution of organisms are all possible with the use of fossil data. By combining fossil evidence with other lines of evidence, a much more detailed and nuanced understanding of Earth's past can be achieved. This knowledge is valuable in predicting how life might respond to environmental changes in the future.

Strategic Allocation to Renewable Energy Assets

Optimizing Portfolio Returns

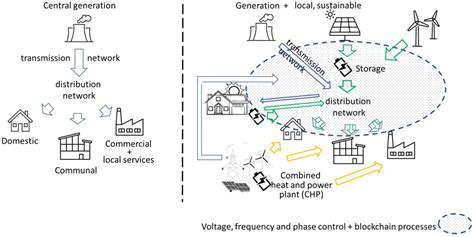

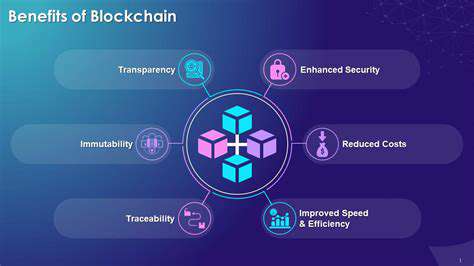

Strategic allocation to renewable energy investments presents a compelling opportunity to enhance portfolio returns while contributing to a sustainable future. Investing in renewable energy companies and projects can offer attractive financial returns, driven by growing demand and supportive government policies. This approach can diversify a portfolio, mitigating risk associated with traditional energy sources, and potentially generating higher long-term returns compared to portfolios solely reliant on fossil fuels. The transition to a low-carbon economy is creating a favorable environment for renewable energy investments. This means that careful research and due diligence are essential to identify promising opportunities.

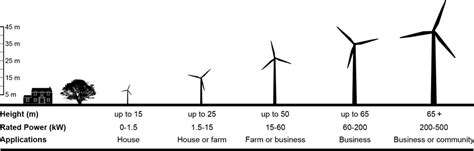

Diversification across various renewable energy sectors, such as solar, wind, and hydropower, can further optimize portfolio returns. Each sector has its own nuances in terms of technology, market dynamics, and regulatory frameworks. Understanding these differences and allocating capital strategically across different sectors can reduce portfolio volatility and potentially yield higher returns compared to a concentrated investment strategy.

Addressing Environmental Concerns

A significant driver for strategic allocation to renewable energy is the growing global concern about climate change. Investors are increasingly seeking investment opportunities that align with their environmental, social, and governance (ESG) values. Renewable energy investments directly address these concerns by reducing greenhouse gas emissions and promoting a cleaner energy future. This growing demand for sustainable investments is driving increased capital flows into the renewable energy sector, further strengthening its growth potential.

The transition away from fossil fuels is accelerating, creating a long-term growth opportunity. This transition is not just good for the environment, but also for the economy, as it supports the creation of new jobs and industries associated with renewable energy technologies. Investors who proactively integrate renewable energy into their portfolios can capture a share of this significant market growth.

Evaluating Technological Advancements

The renewable energy sector is constantly evolving with significant technological advancements. This dynamic environment requires careful monitoring and evaluation of emerging technologies. Staying updated on innovative advancements in solar panel efficiency, wind turbine design, and battery storage technologies is critical for successful allocation. These advancements are driving down the cost of renewable energy, making it increasingly competitive with traditional energy sources.

Careful consideration must be given to the potential risks associated with technological disruptions and the associated uncertainties. Investors must remain vigilant about the ongoing development of innovative technologies and their potential impact on the future of the renewable energy sector. It's essential to invest in companies and projects that are well-positioned to leverage these advancements.

Assessing Regulatory Frameworks

Government policies and regulations play a crucial role in shaping the renewable energy market. Understanding these frameworks is vital for strategic allocation. Government incentives, such as tax credits and subsidies, can significantly impact the profitability of renewable energy projects. Analyzing the regulatory landscape in different regions and countries is essential for identifying opportunities and mitigating potential risks.

Changes in policy can dramatically affect the investment climate. Keeping abreast of evolving regulations and their potential impact on investment returns is crucial for long-term success. This requires a deep understanding of the political and regulatory environment in the markets where investments are made.

Considering Market Volatility and Risk

While renewable energy investments present a strong potential for long-term growth, they are not without inherent risks. Market fluctuations, technological uncertainties, and regulatory changes can all impact investment returns. Understanding and mitigating these risks is crucial for a successful investment strategy.

Thorough due diligence and diversification are paramount in managing these potential risks. A well-defined investment strategy that takes into account market volatility and potential risks is essential to achieve long-term financial goals while contributing to a sustainable future. Building a diversified portfolio across various renewable energy sectors and technologies can help to reduce overall portfolio risk.