The Role of Insurance in Mitigating Renewable Energy Project Risks

Project Scope Creep

One of the most pervasive challenges in project development is scope creep, where the initial project parameters expand beyond the defined boundaries. This often occurs due to unforeseen requirements, changing priorities, or simply a lack of clear communication between stakeholders. Scope creep can quickly spiral out of control, leading to cost overruns and delays. It's crucial to have a well-defined project scope, documented in detail, and to establish a process for managing changes effectively.

Failing to manage scope creep effectively can lead to significant project issues, impacting the project's budget and timeline. It's vital to proactively identify potential scope creep factors and implement strategies to address them. This proactive approach involves ongoing communication with stakeholders and regular reviews of the project's progress against the initial plan.

Resource Constraints

Project development frequently faces resource constraints, including personnel shortages, insufficient funding, and inadequate tools or technology. These limitations can significantly impede progress, leading to delays and a potential compromise in the quality of the final product. Finding creative solutions to overcome these limitations is often essential for successful project completion.

Teams may need to prioritize tasks, explore alternative resources, or negotiate with stakeholders to acquire the necessary resources. The ability to adapt and improvise in the face of resource constraints is a critical skill for project managers.

Time Management Issues

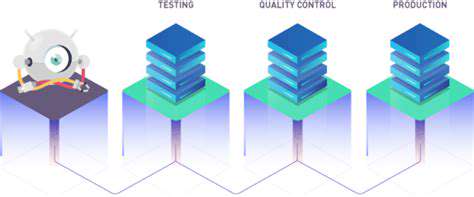

Project development timelines are often ambitious, and effectively managing time is crucial for success. Delays in any aspect of the project, such as design, development, or testing, can cascade through the entire project, leading to substantial time overruns. Poor time management can result in missed deadlines, and the loss of valuable opportunities.

Implementing robust scheduling and task management tools, along with clear communication protocols, can significantly mitigate time-related issues. Regular project reviews and adjustments to the schedule based on progress are also vital to maintain control over the timeline.

Communication Breakdown

Effective communication is essential throughout the project lifecycle. Misunderstandings, inadequate information sharing, or a lack of clarity in communication can lead to conflicts, rework, and ultimately, project failure. Poor communication creates a breeding ground for errors and delays.

Establishing clear communication channels and protocols, fostering open dialogue between team members and stakeholders, and utilizing appropriate communication tools can help overcome communication breakdowns. Regular updates and feedback mechanisms are also crucial for successful project communication.

Stakeholder Management

Managing the expectations and interests of all stakeholders is vital for project success. Disagreements among stakeholders, conflicting priorities, or a lack of stakeholder engagement can lead to project roadblocks and delays. Effective stakeholder management is crucial to ensure that the project remains aligned with the overall goals and objectives.

Actively engaging stakeholders throughout the project lifecycle, clearly defining roles and responsibilities, and providing regular updates on project progress are all important aspects of successful stakeholder management.

Budgetary Constraints

Project development often involves significant financial resources. Budgetary constraints can significantly impact the project's ability to acquire necessary resources, hire skilled personnel, or invest in cutting-edge technology. Overspending on one aspect of the project can compromise other essential areas.

Careful budget planning, realistic estimations, and strict adherence to the approved budget are essential to navigate budgetary challenges. Seeking alternative funding sources or adjusting project scope may be necessary to stay within the budget.

Insurance Coverage Tailored to Specific Project Needs

Understanding Project-Specific Risks

A crucial first step in securing appropriate insurance coverage is a thorough assessment of the unique risks associated with each project. This involves identifying potential hazards specific to the location, activities, and materials involved. Consider factors like the geographical area, the type of construction or operation, potential environmental vulnerabilities, and the possibility of accidents or property damage. Understanding these specific risks allows for a targeted approach to insurance, ensuring protection against unforeseen circumstances.

Analyzing the project's scope, including the timeline, budget, and anticipated outcomes, is also vital. A project with a longer duration or more complex procedures will inherently present more opportunities for problems, necessitating a more comprehensive insurance strategy. By carefully considering these factors, you can proactively identify potential liabilities and implement suitable insurance solutions.

Protecting Against Property Damage

Insurance coverage for property damage is essential for safeguarding assets during a project. This protection can cover a wide range of scenarios, from damage caused by weather events to accidents involving equipment or materials. Comprehensive property insurance policies typically address the replacement cost of damaged structures, equipment, and inventory, minimizing financial losses in the event of unforeseen incidents.

In addition to physical property, it's crucial to consider the protection of intangible assets. Intellectual property rights, for example, require specific insurance tailored to safeguarding designs, patents, or trademarks. This comprehensive approach to property protection ensures that all project assets are secured against potential losses.

Liability Coverage for Project Activities

Project-specific liability insurance is vital for protecting against potential claims arising from injuries or damages sustained by third parties. This coverage is critical for ensuring financial security in case of accidents or incidents involving project personnel or external stakeholders. Assessing potential liabilities, like the involvement of subcontractors or the presence of public access points, is paramount to crafting a comprehensive liability insurance strategy.

This coverage often includes general liability insurance, which can protect against claims for bodily injury or property damage sustained by others due to project activities. Professional liability insurance, covering potential errors or omissions in project execution, is also a critical component to consider.

Insurance for Equipment and Personnel

Comprehensive insurance for the project's equipment and personnel is another critical aspect to consider. Protecting equipment from damage or theft through specialized policies is essential to mitigate financial losses and operational disruptions. This includes coverage for machinery, tools, vehicles, and other critical project assets.

Furthermore, ensuring the well-being of project personnel through appropriate insurance policies is paramount. Worker's compensation insurance safeguards employees from injuries or illnesses sustained during work-related activities. This coverage is not just a legal obligation but a crucial element in fostering a safe and secure work environment for all personnel.

Cybersecurity and Data Protection

In today's digital age, cybersecurity risks are a significant consideration for any project that involves data handling or digital systems. Protecting sensitive project data and intellectual property from cyberattacks and data breaches is crucial, requiring specific coverage that addresses the potential for financial loss or reputational damage. This specialized insurance can cover the costs associated with data recovery, legal fees, and reputational damage.

Implementing robust cybersecurity measures alongside appropriate insurance coverage is vital for mitigating these threats. This proactive approach ensures that sensitive information remains secure and that the project can continue operations even in the face of potential cyber incidents. Data breaches can have devastating consequences for both the project and the people involved, so safeguarding against them is an essential aspect of robust risk management.

Addressing Environmental and Social Risks

Environmental Risks and Insurance

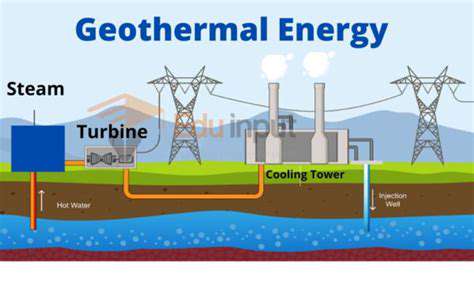

Environmental risks, such as extreme weather events, rising sea levels, and the increasing frequency and intensity of natural disasters, pose significant threats to individuals, communities, and businesses. These events often lead to substantial property damage, business disruptions, and economic losses. Insurance plays a crucial role in mitigating these risks by providing financial protection against these catastrophic events. Insurance companies assess the risks associated with specific locations and develop policies that reflect these risks. The premiums for these policies reflect the likelihood and potential severity of environmental damage. This mechanism helps ensure that resources are available to rebuild and recover from these events, fostering community resilience.

The growing awareness of climate change and its impact on the environment is driving the need for innovative insurance solutions. Insurers are increasingly incorporating climate-related factors into their risk assessments and policy pricing. This includes considering factors like floodplains, wildfire risk, and coastal erosion. By accurately assessing and pricing risk, insurance can incentivize proactive measures to reduce exposure to environmental hazards. For example, insurance companies may offer incentives to homeowners who implement energy-efficient upgrades or adopt sustainable practices.

Social Risks and Insurance Coverage

Social risks, encompassing factors such as poverty, inequality, and social unrest, can significantly impact insurance coverage and access. Areas with high poverty rates often face challenges in accessing affordable insurance and may experience greater vulnerability to environmental risks due to limited resources and infrastructure. Insurance products should be designed to address these vulnerabilities, enabling equitable access and coverage. Community-based insurance programs and social safety nets can play a crucial role in providing support to vulnerable populations during and after disasters.

Social factors like population density and urbanization patterns can influence risk exposure. Insurance companies must consider these factors to develop effective policies that reflect the specific needs of communities. They can leverage data on social indicators, such as access to healthcare, education, and employment opportunities, to better understand the risks and vulnerabilities within different populations. This approach can lead to more equitable and effective insurance solutions that benefit all segments of society.

Insurance Solutions for Mitigating Risks

Insurance companies are developing innovative solutions to address both environmental and social risks. These solutions often involve incorporating climate change projections into risk models to better anticipate future hazards and adjust coverage accordingly. This forward-thinking approach promotes proactive risk management and helps communities prepare for potential future events. Partnerships between insurers, governments, and community organizations can enhance the effectiveness of insurance programs in mitigating risks and building resilience.

Insurers are exploring innovative risk transfer mechanisms, such as catastrophe bonds and risk pools. These mechanisms can diversify risk and provide financial stability in the face of large-scale events. Furthermore, insurance policies can incentivize sustainable practices by offering discounts or premiums based on environmentally friendly behaviors. This creates a positive feedback loop where insurance encourages risk reduction and sustainable development.